Embarking on a journey into the world of cloud financial management, this exploration unveils the pivotal role of finance teams within the FinOps framework. FinOps, a rapidly evolving discipline, empowers organizations to optimize cloud spending, foster collaboration, and drive business value. This guide will delve into the historical context of finance’s involvement in IT spending, and then chart a course towards a new paradigm of collaborative efficiency.

We will dissect the core principles of FinOps, highlighting how they differ from traditional IT finance models. Furthermore, we’ll examine the crucial communication strategies and processes that bridge the gap between finance and FinOps teams. From financial planning and budgeting to cost allocation and reporting, this narrative aims to provide a clear understanding of how finance teams can contribute to cloud cost optimization, governance, and overall success within a FinOps environment.

Understanding FinOps and its Core Principles

In the dynamic landscape of cloud computing, managing costs effectively is paramount. FinOps, a portmanteau of “finance” and “operations,” has emerged as a crucial framework for optimizing cloud spending. It provides a structured approach to help organizations understand, control, and ultimately, reduce their cloud expenses. This section delves into the fundamental concepts of FinOps, highlighting its goals, benefits, core principles, and how it diverges from traditional IT finance practices.

Fundamental Concepts of FinOps

FinOps is a cultural practice that brings together technology, finance, and business teams to promote data-driven cloud financial management. The primary goal is to maximize the business value of cloud spend by empowering teams to make informed decisions. This includes aligning cloud costs with business value, fostering accountability, and enabling continuous optimization.The benefits of adopting a FinOps approach are numerous and can be broadly categorized as:

- Cost Optimization: Identifying and eliminating wasteful spending, right-sizing resources, and leveraging cost-saving opportunities like reserved instances or spot instances.

- Improved Forecasting: Accurately predicting future cloud costs based on usage patterns and business needs, enabling better budgeting and resource allocation.

- Enhanced Collaboration: Breaking down silos between technology, finance, and business teams, fostering a shared understanding of cloud costs and their impact on business outcomes.

- Increased Agility: Empowering engineering teams to make informed decisions about cloud spending, enabling faster innovation and quicker time to market.

- Data-Driven Decision Making: Providing visibility into cloud costs and usage, enabling data-driven decisions about resource allocation, application architecture, and business strategy.

FinOps vs. Traditional IT Finance

Traditional IT finance models often operate in isolation, with a focus on budgeting and cost allocation after the fact. In contrast, FinOps is a collaborative, real-time approach to managing cloud costs.The key differences are:

- Focus: Traditional IT finance primarily focuses on budgeting and cost control, while FinOps focuses on optimizing cloud spend for business value.

- Timing: Traditional IT finance often operates on a quarterly or annual cycle, while FinOps is a continuous, real-time process.

- Collaboration: Traditional IT finance often lacks collaboration between finance and engineering teams, while FinOps emphasizes cross-functional collaboration.

- Visibility: Traditional IT finance often lacks granular visibility into cloud costs, while FinOps provides detailed cost and usage data.

- Responsibility: Traditional IT finance often places responsibility for cost management solely on the finance team, while FinOps distributes responsibility across all teams.

For example, consider a company using a traditional IT finance model. The finance team receives a bill at the end of the month and allocates the costs to different departments. There is little visibility intowhy* the costs increased, and the engineering teams have limited control over their spending. In contrast, a company using FinOps would provide engineering teams with real-time dashboards showing their cloud spending.

They would also implement processes for right-sizing resources and leveraging cost-saving opportunities. This would allow the company to proactively manage its cloud costs and make data-driven decisions.

Core Principles of FinOps

FinOps is built on three core principles: collaboration, optimization, and accountability. These principles guide the practices and behaviors that define a successful FinOps implementation.

- Collaboration: FinOps requires strong collaboration between technology, finance, and business teams. This involves sharing information, setting common goals, and working together to make informed decisions about cloud spending. This is about breaking down silos and fostering a shared understanding of cloud costs and their impact on business outcomes.

- Optimization: FinOps emphasizes continuous optimization of cloud resources to minimize costs without sacrificing performance or business value. This involves identifying and eliminating waste, right-sizing resources, and leveraging cost-saving opportunities. The optimization phase includes processes like:

- Rightsizing: Ensuring that cloud resources are appropriately sized for the workload.

- Reserved Instances/Committed Use Discounts: Leveraging cost-saving options offered by cloud providers.

- Automation: Automating cost-saving tasks.

- Accountability: FinOps promotes accountability for cloud spending across all teams. This involves providing visibility into cloud costs, establishing clear ownership, and empowering teams to make informed decisions about their spending. This means that everyone understands their responsibilities related to cloud costs and takes ownership of their spending decisions.

The Traditional Role of Finance Teams

Historically, finance teams have played a crucial role in managing IT spending, primarily focusing on cost control, budgeting, and financial reporting. Their responsibilities have evolved over time, adapting to technological advancements and shifting business priorities. However, the core principles of financial management – accuracy, compliance, and accountability – have remained constant.

Historical Responsibilities in IT Spending

Prior to the widespread adoption of cloud computing and FinOps, finance teams’ involvement in IT spending centered on a set of well-defined tasks. These tasks were often reactive, focusing on post-facto analysis and control.

- Budgeting and Forecasting: Finance teams were responsible for creating annual IT budgets, forecasting future IT expenses, and monitoring actual spending against budgeted amounts. This involved gathering information from IT departments, analyzing historical spending patterns, and making projections based on anticipated IT needs.

- Procurement and Vendor Management: Managing the procurement process for IT hardware, software, and services was a key responsibility. This included negotiating contracts with vendors, ensuring compliance with procurement policies, and processing invoices.

- Cost Allocation: Finance teams allocated IT costs to different departments or business units. This was typically done using allocation methods based on factors like headcount, usage, or revenue.

- Financial Reporting and Analysis: Finance teams prepared financial reports that included IT spending data, variance analysis, and other key performance indicators (KPIs). They provided insights into cost trends, identified areas of overspending, and supported decision-making.

- Compliance and Audit: Ensuring compliance with financial regulations, internal policies, and audit requirements was a critical function. This involved maintaining accurate records, implementing internal controls, and responding to audit inquiries.

Comparison of Traditional Finance Roles with FinOps

The shift to FinOps represents a significant evolution in how finance teams interact with IT spending. While traditional finance focuses on control and compliance, FinOps emphasizes collaboration, optimization, and continuous improvement. This results in a proactive, data-driven approach to managing cloud costs.

| Traditional Finance | FinOps |

|---|---|

| Focus: Cost control, compliance, and post-facto analysis. | Focus: Cost optimization, collaboration, and proactive management. |

| Perspective: Primarily concerned with financial reporting and budgeting. | Perspective: Shared responsibility with IT, engineering, and business teams. |

| Approach: Reactive, with limited real-time visibility into IT spending. | Approach: Proactive, leveraging real-time data and automation for cost optimization. |

| Metrics: Primarily focused on budget variance and overall IT spend. | Metrics: Granular cost metrics, resource utilization, and business value. |

| Tools: Primarily using spreadsheets, ERP systems, and basic reporting tools. | Tools: Leveraging cloud provider tools, FinOps platforms, and data analytics. |

Key Metrics Used Before FinOps Adoption

Before the advent of FinOps, finance teams relied on a set of key metrics to track and manage IT spending. These metrics provided insights into cost trends, helped identify areas of concern, and supported budget planning. However, these metrics often lacked the granularity and real-time visibility offered by FinOps practices.

- Total IT Spend: The overall amount spent on IT resources, including hardware, software, and services. This was a primary metric for tracking overall IT costs.

- Budget Variance: The difference between the budgeted IT spend and the actual IT spend. This metric helped identify overspending or underspending against the approved budget. For example, a company might budget $1 million for cloud services but spend $1.2 million, resulting in a negative variance of $200,000.

- Cost per Department/Business Unit: The allocation of IT costs to different departments or business units. This metric helped understand how IT spending was distributed across the organization.

- Hardware Costs: The expenses associated with purchasing and maintaining IT hardware, such as servers, storage devices, and network equipment.

- Software Costs: The expenses associated with software licenses, maintenance, and subscriptions.

- Vendor Costs: The spending with various IT vendors, including cloud providers, software vendors, and consulting firms.

- Return on Investment (ROI) on IT Projects: The financial return generated by specific IT projects or investments. This metric was often calculated retrospectively.

Bridging the Gap: Finance and FinOps Collaboration

Successfully integrating finance teams into FinOps requires a strategic approach to communication, data understanding, and collaborative cost optimization. This integration transforms finance from a passive observer to an active participant, driving informed decision-making and maximizing the value of cloud investments. The following sections detail how to build this crucial bridge.

Communication Strategies Between Finance and FinOps Teams

Effective communication is the cornerstone of a successful FinOps implementation. Both teams need to understand each other’s priorities, terminology, and challenges. This understanding fosters trust and collaboration.

Several communication strategies are essential:

- Regular Meetings: Establish recurring meetings, such as weekly or bi-weekly check-ins, to discuss cloud spending, cost optimization efforts, and any emerging issues. These meetings should include representatives from both finance and FinOps teams.

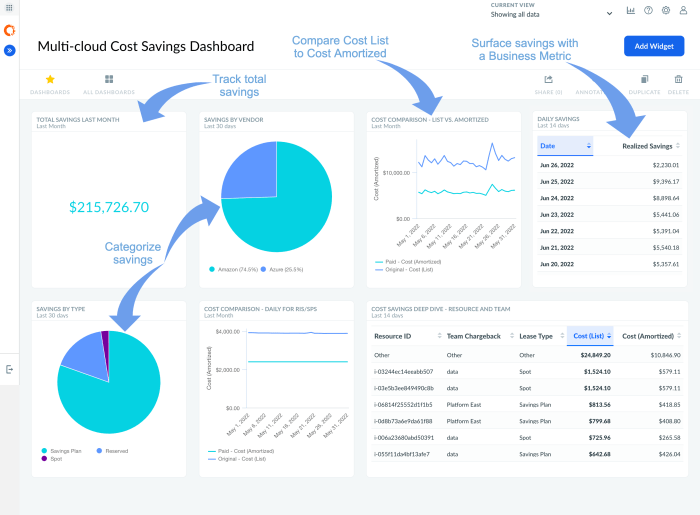

- Shared Dashboards and Reporting: Implement shared dashboards and reports that provide clear, concise, and easily understandable information on cloud spending. These reports should be accessible to both teams and tailored to their respective needs. For example, finance might be interested in overall cost trends, while FinOps focuses on specific cost drivers.

- Standardized Terminology: Develop a common vocabulary for cloud-related terms. This includes definitions for cost categories, resource types, and billing metrics. A glossary or knowledge base accessible to both teams is invaluable.

- Dedicated Communication Channels: Establish dedicated communication channels, such as a Slack channel or email distribution list, for quick communication and issue resolution. This allows for rapid information sharing and the ability to address urgent matters promptly.

- Cross-Functional Training: Provide cross-functional training sessions to educate both teams on FinOps principles, cloud technologies, and financial concepts. This ensures that everyone has a basic understanding of the other team’s responsibilities and challenges.

Framework for Finance Teams to Understand Cloud Spending Data

Finance teams need a clear framework to understand and interpret cloud spending data. This framework should provide insights into cost drivers, trends, and opportunities for optimization.

A structured approach to data understanding includes:

- Cost Allocation and Tagging: Implement a robust cost allocation and tagging strategy. This involves tagging cloud resources with relevant metadata, such as department, project, and application. This allows finance to accurately track and attribute costs to specific business units and initiatives.

- Detailed Reporting: Generate detailed reports that break down cloud spending by various dimensions, such as service, region, and resource type. These reports should provide historical data, current spending, and forecasts.

- Data Visualization: Utilize data visualization tools to present cloud spending data in an easily digestible format. Charts, graphs, and dashboards can help finance teams quickly identify trends, anomalies, and areas for improvement. An example is a stacked bar chart illustrating the cost breakdown by service over time, allowing for quick identification of services driving the most costs.

- Cost Forecasting: Develop cost forecasting models to predict future cloud spending. This involves analyzing historical data, considering planned resource usage, and accounting for any anticipated changes in cloud pricing.

- Establishment of Key Performance Indicators (KPIs): Define and track key performance indicators (KPIs) related to cloud spending, such as cost per unit of output, cost per user, or cost efficiency ratios. This provides a benchmark for measuring progress and identifying areas for improvement. For example, tracking the cost per transaction for a specific application.

Process for Finance to Contribute to Cost Optimization Efforts

Finance teams can play a significant role in cost optimization efforts by providing financial insights, analyzing cost data, and supporting decision-making.

A collaborative process involves:

- Cost Analysis and Reporting: Finance can analyze cloud spending data to identify cost-saving opportunities. This includes identifying underutilized resources, inefficient configurations, and areas where costs can be reduced.

- Budgeting and Forecasting: Finance can integrate cloud spending into the budgeting and forecasting process. This involves creating accurate cost forecasts, setting budgets, and tracking actual spending against those budgets.

- Vendor Negotiation: Finance can assist in negotiating favorable pricing and terms with cloud providers. This includes reviewing contracts, identifying opportunities for discounts, and ensuring that the organization is taking advantage of all available cost-saving options.

- Business Case Analysis: Finance can perform business case analyses to evaluate the financial impact of cloud-related decisions. This includes assessing the costs and benefits of migrating to the cloud, adopting new cloud services, or optimizing existing cloud resources.

- Chargeback and Showback: Implement a chargeback or showback model to allocate cloud costs to different business units or projects. This encourages accountability and motivates teams to optimize their cloud usage. A chargeback model would involve actual cost allocation, while showback provides visibility without direct financial penalties.

Financial Planning and Budgeting in a FinOps Environment

Finance teams play a crucial role in enabling effective cloud financial management. Their ability to forecast cloud spending accurately, integrate cost data into financial planning, and manage cloud budgets is essential for optimizing cloud investments and achieving business goals. This section will detail how finance can contribute to these key areas within a FinOps framework.

Creating Accurate Cloud Spending Forecasts

Accurate forecasting is critical for making informed decisions about cloud investments. Finance teams can leverage various methods to predict future cloud spending.To improve forecasting accuracy, consider these approaches:

- Historical Data Analysis: Analyzing past cloud spending patterns provides a baseline for future projections. This involves examining trends, seasonality, and cost drivers from previous periods. For example, if compute costs increased by 15% in Q1 of the previous year due to a specific marketing campaign, this data can inform predictions for the current year, adjusted for similar campaigns or expected growth.

- Cost Driver Analysis: Identifying and understanding the factors that influence cloud costs is essential. These drivers can include factors like user growth, application usage, data storage needs, and the implementation of new services. Finance can collaborate with engineering and product teams to gather insights into these drivers and build forecasts based on their anticipated impact.

- Scenario Planning: Create multiple forecasts based on different scenarios, such as best-case, worst-case, and most-likely scenarios. This allows for contingency planning and helps to understand the potential range of cloud spending. For example, a company might model scenarios considering a 10%, 20%, or 30% increase in user base, which will directly affect compute and storage costs.

- Machine Learning (ML) and Predictive Analytics: Utilizing ML algorithms can improve forecast accuracy. These algorithms can analyze vast datasets of historical cloud spending, identifying complex patterns and predicting future costs. Tools such as AWS Cost Explorer and Azure Cost Management provide built-in forecasting capabilities powered by ML.

Integrating Cloud Cost Data into Financial Planning Tools

Integrating cloud cost data seamlessly into existing financial planning tools is vital for comprehensive financial management. This integration enables finance teams to view cloud spending alongside other financial metrics and make data-driven decisions.The integration process involves several steps:

- Data Extraction: Extract cloud cost data from cloud provider platforms (AWS, Azure, Google Cloud) using APIs or cost reporting tools.

- Data Transformation: Transform the extracted data into a format compatible with financial planning tools. This may involve cleaning, normalizing, and aggregating data.

- Data Integration: Integrate the transformed data into financial planning tools, such as Adaptive Insights, Oracle EPM Cloud, or Workday Adaptive Planning. This can be achieved through direct integrations, custom scripts, or data warehousing solutions.

- Data Visualization and Reporting: Create dashboards and reports that visualize cloud spending alongside other financial metrics. This enables finance teams to monitor cloud costs, identify trends, and make informed decisions.

Example: A company using Adaptive Insights can import AWS cost data through a connector, allowing finance teams to view cloud costs alongside revenue, expenses, and other financial data. This integrated view provides a holistic understanding of the company’s financial performance.

Setting and Managing Cloud Budgets

Finance teams are responsible for setting and managing cloud budgets, ensuring that cloud spending aligns with business goals and financial constraints.Key aspects of cloud budget management include:

- Budget Creation: Define cloud budgets based on business needs, historical data, and future projections. This involves setting budget limits for various cloud services, departments, or projects. Budgets should be granular enough to allow for effective monitoring and control.

- Budget Monitoring: Continuously monitor cloud spending against the established budgets. This involves tracking actual spending, identifying variances, and taking corrective actions when necessary. Cloud provider tools and FinOps platforms offer real-time monitoring capabilities.

- Alerting and Notifications: Implement alerts and notifications to notify finance teams when cloud spending exceeds predefined thresholds. This allows for timely intervention and prevents overspending.

- Cost Optimization: Collaborate with engineering and operations teams to identify and implement cost optimization strategies. This can involve rightsizing instances, utilizing reserved instances or committed use discounts, and optimizing storage configurations.

- Variance Analysis: Analyze any budget variances to understand the causes and identify areas for improvement. This helps refine future budgets and improve cost control.

Example: A company sets a monthly budget of $100,000 for compute resources. Using cloud provider monitoring tools, the finance team receives an alert when spending reaches $90,000. The team then investigates the spending patterns and identifies an opportunity to optimize the use of reserved instances, leading to cost savings and ensuring the budget is met.

Cost Allocation and Chargeback Mechanisms

Finance teams play a crucial role in establishing and maintaining effective cost allocation and chargeback mechanisms within a FinOps framework. This involves distributing cloud costs accurately across various business units, projects, or teams. This transparency is essential for accountability, informed decision-making, and optimizing cloud spending. Implementing these mechanisms requires a collaborative approach between finance, engineering, and operations teams.

Implementing Cost Allocation Strategies

Finance teams can employ several strategies to allocate cloud costs effectively. The goal is to attribute costs to the appropriate consuming entity.

- Tagging and Metadata: Implementing a robust tagging strategy is foundational. This involves assigning metadata tags to cloud resources (e.g., virtual machines, databases, storage buckets). These tags categorize resources by project, department, application, environment (development, testing, production), or other relevant dimensions. This allows for granular cost tracking and allocation. For example, a tag might identify a specific application team responsible for a particular set of resources.

- Cost Centers and Business Units: Define cost centers or business units to represent different departments or teams within the organization. These units become the recipients of allocated cloud costs. Cost allocation then involves assigning costs to these cost centers based on resource usage.

- Resource-Based Allocation: This approach allocates costs based on the consumption of specific cloud resources. For instance, the cost of a virtual machine instance is allocated to the project or team that uses it. Similarly, the cost of storage is allocated based on the amount of data stored by each team. This requires detailed monitoring and tracking of resource utilization.

- Hybrid Allocation: A combination of methods can be used. For example, a base cost might be allocated based on the number of users within a department, and then additional costs are allocated based on resource usage. This provides flexibility in addressing varying consumption patterns.

- Automation: Automate cost allocation processes using cloud provider tools, third-party FinOps platforms, or custom scripts. Automation minimizes manual effort, reduces errors, and ensures timely cost reporting.

Chargeback Models Suitable for FinOps Environments

Several chargeback models can be implemented to allocate cloud costs to internal consumers. These models should be transparent, fair, and promote efficient cloud usage.

- Showback: This is the simplest model, where the finance team reports cloud costs to the consuming entities without actually charging them. The focus is on transparency and awareness. This model helps teams understand their cloud spending and identify areas for optimization. The main advantage is that there is no financial transaction.

- Cost-Plus: In this model, costs are calculated and allocated to the consuming entities with a pre-determined markup. This markup can cover the finance team’s overhead or a profit margin. This model is often used when providing cloud services internally.

- Fixed-Price: A fixed price is agreed upon upfront for a specific set of cloud resources or services. This model simplifies budgeting and forecasting. This is useful for predictable workloads with steady resource requirements.

- Consumption-Based: This model charges consuming entities based on their actual cloud resource usage. The price is determined by the specific cloud services consumed, such as CPU hours, data transfer, and storage. This is the most accurate and flexible model, but it requires detailed tracking and reporting.

- Tiered Pricing: This is a consumption-based model with different pricing tiers. The cost per unit decreases as consumption increases. This incentivizes efficient resource usage and can be attractive to large consumers.

Procedures for Ensuring Transparency in Cloud Cost Distribution

Transparency is crucial for building trust and ensuring the success of FinOps. The following procedures are important.

- Regular Reporting: Generate regular cost reports (e.g., monthly, quarterly) that detail cloud spending by cost center, project, or other relevant dimensions. Reports should be easily accessible and understandable.

- Detailed Breakdown: Provide a detailed breakdown of costs, including the specific cloud services consumed, the associated costs, and the allocated cost centers.

- Clear Communication: Communicate cost allocation policies and procedures clearly to all stakeholders. Provide training and support to help teams understand how costs are allocated and how they can optimize their spending.

- Audit Trails: Maintain audit trails of cost allocation processes to ensure accuracy and accountability. This includes documenting the tagging strategy, cost allocation rules, and any adjustments made.

- Feedback Mechanisms: Establish feedback mechanisms to allow consuming entities to raise questions, provide feedback, and challenge cost allocations. This ensures fairness and promotes continuous improvement.

- Regular Reviews: Conduct regular reviews of cost allocation models and procedures to ensure they remain relevant and effective. Adapt the models as the cloud environment and business needs evolve.

Reporting and Analysis of Cloud Costs

Finance teams play a crucial role in analyzing and reporting cloud costs, ensuring transparency and enabling data-driven decision-making within a FinOps framework. Effective reporting provides insights into spending patterns, identifies areas for optimization, and supports accurate forecasting. This section will explore the types of reports finance teams generate, the tools used for reporting, and the key performance indicators (KPIs) relevant to cloud cost management.

Types of Reports Finance Teams Need to Generate for FinOps

Finance teams need to generate various reports to effectively manage cloud spending. These reports provide different perspectives on cloud costs and help stakeholders understand and control their spending.

- Cost Summary Reports: These reports offer an overview of cloud spending, typically broken down by service, department, and time period (e.g., daily, weekly, monthly). They provide a high-level view of overall cloud costs and highlight significant cost drivers.

- Cost Allocation Reports: These reports show how cloud costs are allocated across different teams, projects, or business units. They help in understanding who is responsible for what cloud spending and facilitate chargeback or showback mechanisms.

- Anomaly Detection Reports: These reports identify unusual spending patterns or unexpected cost increases. They often leverage machine learning to detect deviations from historical trends, alerting finance teams to potential issues early on. For example, a sudden spike in compute costs could indicate a misconfigured instance or an unexpected workload.

- Optimization Opportunity Reports: These reports highlight potential cost-saving opportunities, such as unused resources, rightsizing recommendations, or reserved instance utilization improvements. They provide actionable insights for optimizing cloud infrastructure and reducing waste.

- Forecasting Reports: These reports predict future cloud spending based on historical data and current usage patterns. They help finance teams budget effectively and anticipate future costs. Forecasting reports often incorporate different scenarios and consider factors like planned application deployments and seasonal fluctuations in demand.

- Compliance Reports: These reports track cloud spending against budgetary constraints and regulatory requirements. They ensure that cloud spending aligns with the organization’s financial policies and governance practices.

Comparison of Different Reporting Tools and Their Suitability for Finance Teams

Various reporting tools are available to help finance teams analyze and visualize cloud costs. The choice of tool depends on the organization’s specific needs, cloud provider, and budget.

- Cloud Provider Native Tools: Cloud providers like AWS (Cost Explorer, Cost and Usage Reports), Azure (Cost Management + Billing), and Google Cloud (Cloud Billing) offer built-in reporting and analysis tools. These tools provide detailed cost data, dashboards, and reporting capabilities specific to their respective platforms. They are generally cost-effective and easy to set up. However, they may lack cross-cloud visibility and advanced analytics features.

For instance, AWS Cost Explorer allows users to visualize cost trends, filter data by various dimensions (e.g., service, region, tag), and set up cost alerts.

- Third-Party FinOps Platforms: Several third-party FinOps platforms specialize in cloud cost management, providing advanced reporting, optimization recommendations, and automation capabilities. These platforms often integrate with multiple cloud providers and offer features like cost allocation, anomaly detection, and forecasting. Examples include CloudHealth by VMware, Apptio Cloudability, and Kubecost. These tools often offer more sophisticated features but come at a higher cost. For example, CloudHealth allows users to create custom dashboards, automate cost allocation, and receive proactive recommendations for cost optimization.

- Business Intelligence (BI) Tools: BI tools like Tableau, Power BI, and Looker can be used to analyze cloud cost data. These tools can connect to cloud provider APIs or data warehouses to visualize and analyze cloud spending. They offer powerful data visualization capabilities and allow for custom reporting. However, they may require more technical expertise to set up and maintain.

- Spreadsheet Software: Simple tools like Microsoft Excel or Google Sheets can be used for basic cost analysis and reporting. They are easy to use and readily available. However, they may not be suitable for large datasets or complex analysis.

Key Performance Indicators (KPIs) Relevant to Cloud Cost Management

Finance teams need to track several key performance indicators (KPIs) to monitor and manage cloud costs effectively. These KPIs provide insights into the efficiency, effectiveness, and financial performance of cloud spending.

- Cost per Unit: Measures the cost of delivering a specific unit of output or service. For example, cost per transaction, cost per user, or cost per gigabyte of storage.

- Cloud Cost Efficiency: Evaluates how efficiently cloud resources are being utilized. It can be calculated as the ratio of business value delivered to cloud spend.

- Cost Optimization Rate: Indicates the percentage of potential cost savings achieved through optimization efforts. It can be calculated as:

(Cost Savings / Total Cloud Spend)

– 100 - Reserved Instance (RI) Utilization: Measures the percentage of reserved instances that are being utilized. High utilization indicates efficient use of reserved instances and potential cost savings.

- Coverage: Measures the percentage of your on-demand instances covered by reserved instances or savings plans. Higher coverage generally means a lower effective rate.

- Budget Variance: Tracks the difference between planned and actual cloud spending. A significant variance can indicate issues with forecasting or cost control.

- Chargeback Accuracy: Measures the accuracy of cost allocation and chargeback processes. High accuracy ensures that costs are fairly allocated to the responsible teams or business units.

- Cloud Spend Growth Rate: Measures the rate at which cloud spending is increasing over time. This KPI helps in forecasting future costs and identifying potential cost drivers.

Driving Optimization and Efficiency

Finance teams play a critical role in fostering a culture of cloud cost optimization and ensuring that cloud resources are utilized efficiently. Their involvement extends beyond simply tracking spending; they are instrumental in identifying opportunities for savings, validating the effectiveness of optimization efforts, and driving continuous improvement. This proactive approach ensures that cloud investments deliver maximum value.

Supporting Cloud Cost Optimization Initiatives

Finance supports cloud cost optimization by providing financial insights and analytical capabilities. This support includes understanding cloud spending patterns and identifying areas where costs can be reduced.

- Analyzing Spend Data: Finance teams analyze detailed cloud spending data to identify cost drivers, anomalies, and potential optimization opportunities. This includes breaking down costs by service, department, and project. They use tools and techniques like data visualization and dashboards to make the information accessible and actionable. For example, by analyzing historical data, finance can identify periods of peak usage and suggest right-sizing instances during off-peak hours.

- Developing Cost Models: Finance develops and maintains cost models to predict future cloud spending and assess the financial impact of different cloud usage scenarios. These models are essential for forecasting and budgeting. These models consider factors such as instance types, data transfer, and storage costs.

- Establishing Cost-Saving Targets: Finance collaborates with engineering and operations teams to set realistic and measurable cost-saving targets. These targets are aligned with overall business goals and are regularly reviewed and adjusted based on performance. For instance, a company might set a target to reduce cloud infrastructure costs by 15% within the next quarter by implementing specific optimization strategies.

- Evaluating Optimization Strategies: Finance assesses the financial impact of various cloud optimization strategies, such as reserved instances, spot instances, and auto-scaling. They provide cost-benefit analyses to help teams prioritize optimization efforts.

- Monitoring and Reporting: Finance monitors cloud spending against budgets and forecasts and reports on the progress of cost-saving initiatives. This reporting includes key performance indicators (KPIs) such as cost per unit of output and cloud cost efficiency ratios.

Designing Strategies for Resource Utilization Reviews

Finance participates in resource utilization reviews to ensure cloud resources are used efficiently and effectively. These reviews are collaborative efforts involving finance, engineering, and operations teams.

- Participating in Regular Reviews: Finance teams participate in regular reviews of cloud resource utilization, such as monthly or quarterly performance meetings. During these meetings, they analyze cost data, identify areas of waste, and recommend optimization actions.

- Analyzing Resource Usage: Finance analyzes resource usage data to identify underutilized or over-provisioned resources. This analysis can involve identifying instances that are idle for significant periods or those with low CPU utilization.

- Providing Cost Insights: Finance provides cost insights to engineering and operations teams, such as the cost of running different instance types or the financial impact of scaling resources. They also help prioritize optimization efforts based on cost-saving potential.

- Recommending Optimization Actions: Based on their analysis, finance recommends specific optimization actions, such as right-sizing instances, consolidating resources, or implementing auto-scaling.

- Tracking and Reporting on Optimization Outcomes: Finance tracks the outcomes of optimization actions and reports on the resulting cost savings. This involves comparing pre- and post-optimization costs and quantifying the financial benefits.

Organizing a Process for Monitoring and Validating Cost-Saving Efforts

Finance organizes a structured process to monitor and validate the effectiveness of cost-saving efforts. This process ensures that optimization initiatives deliver the expected financial benefits.

- Establishing Baseline Costs: Finance establishes a baseline of cloud costs before implementing any optimization efforts. This baseline serves as a reference point for measuring the impact of optimization.

- Tracking Optimization Activities: Finance tracks all optimization activities, such as right-sizing instances, implementing reserved instances, and utilizing spot instances. This tracking ensures that all optimization efforts are accounted for.

- Monitoring Cost Savings: Finance monitors the cost savings achieved through optimization efforts. This monitoring involves comparing actual costs with the baseline costs and tracking the financial impact of each optimization action.

- Validating Cost Savings: Finance validates the cost savings achieved by comparing the actual savings with the projected savings. This validation ensures that optimization efforts are delivering the expected financial benefits.

- Reporting and Analysis: Finance prepares regular reports on the progress of cost-saving efforts, including the financial benefits achieved, the status of ongoing initiatives, and recommendations for further optimization. These reports are shared with stakeholders across the organization.

- Continuous Improvement: The process is designed for continuous improvement. Based on the results of monitoring and validation, finance works with other teams to refine optimization strategies and identify new opportunities for cost savings.

Governance and Compliance in FinOps

Ensuring cloud spending aligns with regulatory requirements and internal policies is crucial for financial stability and risk management. Finance teams play a pivotal role in establishing and maintaining robust governance and compliance frameworks within a FinOps environment. This involves a proactive approach to monitor, control, and audit cloud expenditures, mitigating potential financial and legal risks.

Creating a System for Compliance with Regulations

Finance teams must establish a comprehensive system to ensure cloud spending adheres to all relevant regulations, such as GDPR, HIPAA, or industry-specific compliance standards. This requires a multi-faceted approach, encompassing policy development, implementation, and ongoing monitoring.

- Policy Development and Documentation: Define clear cloud spending policies aligned with regulatory requirements. These policies should cover aspects such as data storage, data residency, data security, and access controls. Thorough documentation is essential for transparency and auditability. For example, a policy might stipulate that all sensitive customer data must reside within a specific geographic region, adhering to data residency regulations.

- Technology Implementation: Implement cloud-native tools or third-party solutions to enforce policies. These tools can automate compliance checks, flag potential violations, and generate reports. For instance, automated tools can scan cloud storage buckets to ensure that data encryption is enabled, meeting security compliance standards.

- Access Controls and Permissions Management: Implement robust access controls and permissions management within the cloud environment. This includes the principle of least privilege, ensuring users only have access to the resources they need. Regular audits of user permissions are necessary to identify and remediate any potential violations.

- Regular Monitoring and Reporting: Establish a system for continuous monitoring of cloud spending and usage to identify potential compliance issues. This includes generating regular reports on spending patterns, data storage locations, and security configurations. Any deviations from established policies or regulations should be flagged and addressed promptly.

- Training and Awareness: Provide regular training to finance, IT, and other relevant teams on cloud compliance requirements. This ensures everyone understands their responsibilities and can effectively contribute to maintaining a compliant environment.

Contribution to Cloud Governance Policies

Finance teams are instrumental in shaping and implementing cloud governance policies. Their expertise in financial management, risk assessment, and cost control provides a critical perspective in developing effective governance frameworks.

- Cost Allocation and Budgeting: Collaborate with IT and business units to develop detailed cost allocation models and budgets for cloud spending. This ensures that cloud costs are accurately attributed to the responsible departments or projects, providing transparency and accountability.

- Resource Optimization Strategies: Identify and implement resource optimization strategies to reduce cloud spending while maintaining performance and availability. This includes rightsizing instances, utilizing reserved instances, and leveraging spot instances.

- Security and Compliance Requirements: Integrate security and compliance requirements into cloud governance policies. This includes data encryption, access controls, and regular security audits.

- Policy Enforcement and Automation: Collaborate with IT teams to implement automated policy enforcement mechanisms within the cloud environment. This includes setting up alerts for unusual spending patterns or non-compliant resource configurations.

- Regular Policy Reviews and Updates: Establish a process for regular reviews and updates of cloud governance policies to reflect changing business needs, regulatory requirements, and technological advancements.

Auditing Cloud Spending and Usage

Finance teams are responsible for conducting regular audits of cloud spending and usage to ensure accuracy, compliance, and cost efficiency. This involves reviewing invoices, analyzing spending patterns, and identifying areas for improvement.

- Invoice Verification: Implement a process for verifying cloud invoices to ensure accuracy and identify any discrepancies. This includes comparing invoices to usage reports and validating pricing.

- Spending Analysis: Analyze cloud spending patterns to identify areas of overspending or inefficient resource utilization. This can involve using cloud cost management tools to track spending by service, region, and department.

- Compliance Audits: Conduct regular audits to ensure that cloud spending complies with all relevant regulations and internal policies. This includes verifying data storage locations, data security measures, and access controls.

- Cost Optimization Recommendations: Based on audit findings, provide recommendations for cost optimization and efficiency improvements. This may include rightsizing instances, utilizing reserved instances, or implementing automated scaling.

- Reporting and Communication: Prepare regular reports on cloud spending, usage, and compliance for finance, IT, and business stakeholders. Communicate audit findings and recommendations effectively to drive improvements.

Future Trends and the Evolving Role of Finance

The FinOps landscape is dynamic, constantly evolving with advancements in cloud technology and shifts in business priorities. The role of finance teams is also undergoing a significant transformation. Understanding these emerging trends and preparing for future challenges is crucial for finance professionals to remain relevant and contribute effectively to cloud cost management and optimization. This section will explore the key trends, provide insights into future challenges, and offer predictions on how the finance function will evolve within the FinOps framework.

Emerging Trends Shaping Finance in FinOps

Several key trends are reshaping the role of finance within the FinOps framework. These trends highlight the increasing importance of data-driven decision-making, automation, and collaboration.

- Increased Automation and AI Integration: Automation is becoming increasingly prevalent in FinOps, with AI and machine learning playing a crucial role in cost optimization, anomaly detection, and forecasting. Finance teams will need to leverage these technologies to analyze vast amounts of data, identify cost-saving opportunities, and improve the accuracy of financial predictions. For example, automated anomaly detection systems can flag unusual spending patterns in real-time, allowing finance teams to address potential issues before they escalate.

- Rise of Cloud-Native Applications and Serverless Computing: The adoption of cloud-native applications and serverless computing is accelerating. These technologies offer significant benefits in terms of scalability and cost efficiency, but they also introduce new complexities in cost management. Finance teams must understand these new models and adapt their budgeting, forecasting, and reporting practices accordingly. This includes understanding the nuances of pay-per-use pricing models and the implications for long-term cost planning.

- Focus on Sustainability and Green IT: Environmental sustainability is becoming a key consideration for businesses. FinOps is evolving to incorporate green IT practices, focusing on reducing the carbon footprint of cloud operations. Finance teams will be responsible for tracking and reporting on the environmental impact of cloud spending, as well as helping to identify and implement strategies to reduce energy consumption. This could involve choosing cloud providers with sustainable infrastructure or optimizing resource utilization to minimize waste.

- Enhanced Collaboration and Cross-Functional Teams: FinOps thrives on collaboration between finance, engineering, and business teams. This trend will continue to strengthen, with finance professionals playing a key role in facilitating communication, aligning goals, and ensuring that cloud spending decisions are aligned with business objectives. This requires finance teams to develop strong communication skills and a deep understanding of cloud technologies and business operations.

Preparing for Future Challenges

Finance teams must proactively prepare for the challenges and opportunities presented by these evolving trends. This involves investing in skills development, adopting new technologies, and fostering a culture of collaboration and innovation.

- Upskilling and Training: Finance professionals need to acquire new skills and knowledge to effectively navigate the FinOps landscape. This includes training in cloud technologies, data analytics, automation tools, and FinOps methodologies. Investing in professional certifications, such as the FinOps Certified Practitioner (FOCP), can provide a solid foundation in FinOps principles and practices.

- Adopting New Technologies: Finance teams should embrace new technologies that can streamline their FinOps processes. This includes cloud cost management platforms, data visualization tools, and automation solutions. These tools can help automate tasks, improve data analysis, and provide real-time insights into cloud spending.

- Building Strong Partnerships: Fostering strong relationships with engineering, DevOps, and business teams is essential. Finance professionals should actively participate in cross-functional teams, share insights, and collaborate on cloud cost optimization initiatives. This requires a shift in mindset from a traditional “gatekeeper” role to a collaborative partner.

- Developing Data-Driven Decision-Making: Finance teams must leverage data analytics to make informed decisions about cloud spending. This includes analyzing historical cost data, identifying trends, and forecasting future costs. This data-driven approach enables proactive cost management and optimization.

Predictions on the Evolution of the Finance Function

The finance function will undergo a significant transformation in the FinOps landscape. Here are some predictions on how the role will evolve:

- Strategic Advisors: Finance professionals will become strategic advisors, providing insights and recommendations on cloud spending to business leaders. They will help to align cloud spending with business objectives and drive data-driven decision-making.

- Data Scientists and Analysts: Finance teams will need to develop strong data analysis skills to analyze cloud cost data, identify trends, and generate actionable insights. They will use data visualization tools to communicate findings to stakeholders.

- Automation Experts: Finance professionals will leverage automation tools to streamline FinOps processes, such as cost allocation, reporting, and forecasting. They will work with engineering teams to implement automated cost optimization strategies.

- Sustainability Champions: Finance teams will play a crucial role in promoting sustainable cloud practices. They will track and report on the environmental impact of cloud spending and help to identify and implement strategies to reduce energy consumption. For example, a finance team could work with engineering to analyze the carbon footprint of different cloud services and recommend the most energy-efficient options.

- Cross-Functional Collaborators: Finance professionals will work closely with engineering, DevOps, and business teams to foster a collaborative environment. They will facilitate communication, align goals, and ensure that cloud spending decisions are aligned with business objectives.

Closing Notes

In conclusion, the integration of finance teams within FinOps is no longer a choice but a necessity. By embracing collaboration, leveraging data-driven insights, and actively participating in cost optimization initiatives, finance teams can become true partners in cloud financial management. As the FinOps landscape continues to evolve, finance professionals who adapt and embrace these changes will be best positioned to drive efficiency, ensure compliance, and unlock the full potential of cloud investments.

The future of finance is inextricably linked with FinOps, and this is a future of increased value and strategic influence.

Popular Questions

What specific skills should finance teams develop to succeed in FinOps?

Finance teams should enhance their data analysis skills, become proficient with cloud cost management tools, and cultivate strong communication and collaboration abilities. A solid understanding of cloud services and their associated costs is also crucial.

How can finance teams measure the success of their FinOps efforts?

Success can be measured through several key performance indicators (KPIs), including reduced cloud spend, improved resource utilization, enhanced forecasting accuracy, and increased alignment between business and IT goals. Tracking the time to market of new features and services is also very relevant.

What are the biggest challenges finance teams face when implementing FinOps?

Common challenges include a lack of data visibility, difficulties in aligning teams, resistance to change, and the complexity of cloud pricing models. Overcoming these hurdles requires strong leadership, clear communication, and a phased approach to implementation.

How does FinOps impact the relationship between IT and finance?

FinOps fosters a more collaborative and transparent relationship between IT and finance. By working together, these teams can make informed decisions, optimize cloud spending, and drive business value. It moves away from a reactive, cost-focused approach to a proactive, value-driven partnership.