Understanding how to integrate FinOps with your financial systems is crucial in today’s cloud-driven world. This integration empowers organizations to gain unprecedented control over their cloud spending, fostering efficiency and strategic decision-making. By aligning financial operations with cloud usage, businesses can optimize costs, improve resource allocation, and drive innovation with greater financial predictability.

This comprehensive guide delves into the core principles of FinOps, the intricacies of financial systems, and the practical steps needed to achieve seamless integration. We will explore the challenges, solutions, and best practices, providing you with the knowledge and tools necessary to navigate the complexities of cloud cost management and financial optimization.

Understanding FinOps and Financial Systems Integration

Integrating FinOps with financial systems is crucial for effective cloud cost management and financial governance. This section delves into the core principles of FinOps, the role of financial systems, and the challenges and data flows involved in this integration.

Core Principles of FinOps and Cloud Cost Management Relevance

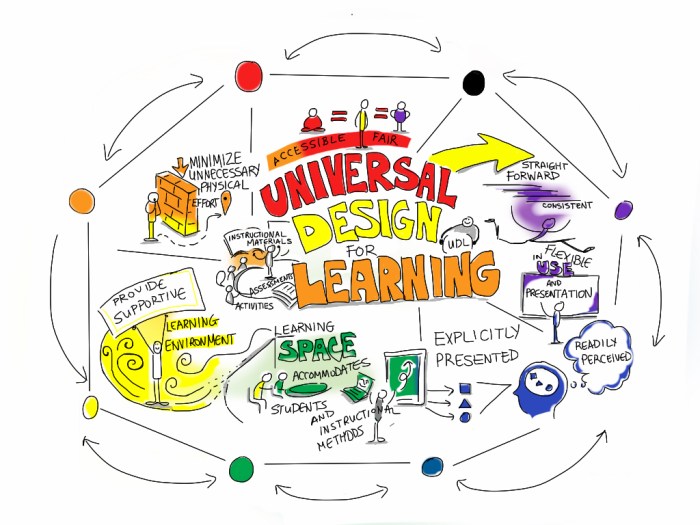

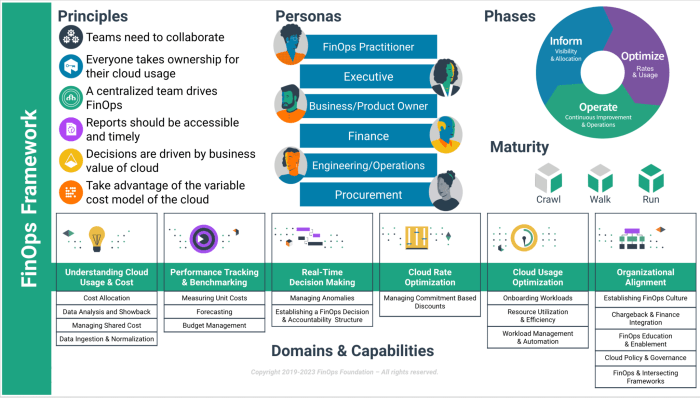

FinOps is a cloud financial management discipline that helps organizations understand cloud spending, make informed decisions, and optimize cloud usage. It is a collaborative effort involving engineering, finance, and business teams.The core principles of FinOps are:

- Collaboration: Fostering communication and shared responsibility between technical and financial teams. This ensures everyone understands the financial implications of their decisions.

- Optimization: Continuously identifying and implementing cost-saving measures, such as rightsizing instances, utilizing reserved instances, and eliminating waste.

- Visibility: Providing clear and accurate visibility into cloud spending, enabling teams to track costs, identify trends, and make data-driven decisions.

- Automation: Automating cost tracking, reporting, and optimization processes to improve efficiency and reduce manual effort.

- Value: Focusing on maximizing the business value derived from cloud investments, ensuring that spending aligns with business goals.

FinOps is highly relevant to cloud cost management because it provides a framework for:

- Cost Allocation: Assigning cloud costs to specific teams, projects, or services, enabling better understanding of spending patterns.

- Cost Optimization: Identifying and implementing cost-saving opportunities, such as choosing the right instance types, utilizing reserved instances, and scaling resources effectively.

- Forecasting and Budgeting: Predicting future cloud spending based on historical data and usage patterns, allowing for better financial planning.

- Reporting and Analysis: Generating reports and dashboards that provide insights into cloud spending, enabling data-driven decision-making.

Financial Systems and Their Role

Financial systems are essential for managing an organization’s financial activities, including accounting, budgeting, and reporting. These systems play a critical role in the integration of FinOps practices.Several types of financial systems are relevant:

- Enterprise Resource Planning (ERP) Systems: These systems integrate various business processes, including finance, human resources, supply chain management, and manufacturing. They often serve as the central repository for financial data. Examples include SAP, Oracle NetSuite, and Microsoft Dynamics 365.

- Accounting Software: These systems are specifically designed for managing accounting functions, such as general ledger, accounts payable, and accounts receivable. Examples include QuickBooks, Xero, and Sage Intacct.

- Budgeting and Forecasting Tools: These tools help organizations create and manage budgets, forecast future financial performance, and track actual spending against budget. Examples include Adaptive Insights, Anaplan, and Vena.

- Cost Management Systems: These systems are designed to track and analyze costs, including cloud costs. They often integrate with other financial systems to provide a comprehensive view of financial performance. Examples include CloudHealth by VMware and Apptio.

The role of these financial systems in FinOps integration is to:

- Provide a source of truth for financial data: Financial systems store and manage the organization’s financial data, including revenue, expenses, and assets.

- Enable cost allocation and reporting: Financial systems can be used to allocate cloud costs to specific teams, projects, or services and generate reports on cloud spending.

- Support budgeting and forecasting: Financial systems can be used to create and manage budgets, forecast future cloud spending, and track actual spending against budget.

- Facilitate financial governance: Financial systems can be used to enforce financial policies and procedures, ensuring that cloud spending aligns with the organization’s financial goals.

Challenges of Integrating FinOps with Existing Financial Systems

Integrating FinOps practices with existing financial systems presents several challenges. Addressing these challenges is critical for successful cloud cost management.Some of the primary challenges include:

- Data Silos: Cloud cost data often resides in separate systems from traditional financial data, creating data silos that make it difficult to get a complete picture of cloud spending.

- Data Granularity: Cloud cost data can be highly granular, with detailed information about individual resources and services. This level of detail may not align with the more aggregated data typically used in financial systems.

- Data Transformation: Transforming cloud cost data into a format that is compatible with financial systems can be complex and time-consuming.

- Lack of Automation: Manual processes for data integration and reporting can be inefficient and prone to errors.

- Organizational Silos: Collaboration between engineering, finance, and business teams can be challenging, leading to miscommunication and a lack of shared responsibility.

- Complexity of Cloud Environments: The dynamic and complex nature of cloud environments can make it difficult to track and manage cloud costs effectively.

Addressing these challenges requires careful planning, a phased approach, and a commitment to collaboration and automation.

Data Flow Diagram: FinOps Tools and Financial Systems

The following diagram illustrates the typical data flow between FinOps tools and financial systems:

+---------------------+ | Cloud Providers | +---------+-----------+ | (Usage & Cost Data) | +---------V-----------+ | FinOps Tools | | (Cost Analysis, | | Optimization, | | Reporting) | +---------+-----------+ | (Data Transformation & Aggregation) | +-----------------------+-----------------------+ | | | V V V +---------------------+ +---------------------+ +---------------------+ | Cost Allocation & | | Budgeting & | | Reporting & | | Reporting Tools | | Forecasting Tools | | Analysis Tools | +---------+-----------+ +---------+-----------+ +---------+-----------+ | | | | (Cost Data, | (Budget Data, | (Performance | | Allocations) | Forecasts) | Metrics) | | | | +---------V-----------+ +---------V-----------+ +---------V-----------+ | Financial Systems | | Financial Systems | | Financial Systems | | (ERP, Accounting, | | (Budgeting, | | (Dashboards, | | Cost Management) | | Forecasting) | | Financial Reports)| +---------------------+ +---------------------+ +---------------------+

Diagram Description:

The diagram depicts a data flow starting with Cloud Providers (e.g., AWS, Azure, GCP) generating usage and cost data. This data is ingested by FinOps Tools, which perform cost analysis, optimization, and reporting. FinOps tools then feed transformed and aggregated data to three key areas: Cost Allocation & Reporting Tools, Budgeting & Forecasting Tools, and Reporting & Analysis Tools.

These tools then integrate with Financial Systems (e.g., ERP, accounting software) to update cost allocation, budgeting, forecasting, and reporting processes. The diagram highlights the iterative nature of FinOps, enabling continuous feedback and optimization. The direction of the arrows illustrates the flow of information, starting from the cloud providers and ultimately feeding into the financial systems for comprehensive financial management.

Assessing Current Financial System Capabilities

Evaluating your existing financial systems is a crucial first step in integrating FinOps. Understanding the current capabilities, limitations, and data structures within your financial systems allows for a more informed and effective FinOps implementation strategy. This assessment helps identify gaps and opportunities for improvement, ensuring a smoother transition and maximizing the benefits of FinOps.

Existing Financial Reporting Capabilities of Common Financial Systems

Financial systems offer a range of reporting capabilities, varying in sophistication and features depending on the system. Understanding these capabilities is vital for leveraging them in a FinOps framework.

Common reporting features include:

- General Ledger Reporting: Provides fundamental financial statements like the balance sheet, income statement, and cash flow statement. These reports offer a high-level view of financial performance but may lack the granular detail needed for cloud cost analysis.

- Cost Center Reporting: Allows organizations to track expenses by department, project, or other defined cost centers. This feature is helpful for allocating cloud costs to specific business units.

- Budgeting and Forecasting: Enables organizations to create budgets, track actual spending against budgets, and forecast future financial performance. Integrating cloud cost data into budgeting and forecasting processes is essential for proactive cost management.

- Variance Analysis: Compares actual financial results to budgeted figures, identifying variances and highlighting areas that require attention. This analysis is crucial for understanding cloud cost fluctuations and identifying cost-saving opportunities.

- Transaction-Level Reporting: Provides detailed information about individual financial transactions, including dates, amounts, and associated accounts. This level of detail is often necessary for investigating specific cloud cost drivers.

- Custom Reporting: Many financial systems offer the ability to create custom reports tailored to specific business needs. This flexibility is valuable for developing FinOps-specific reports that track cloud cost metrics.

Comparing and Contrasting Financial Systems Regarding Their Cloud Cost Tracking Features

Different financial systems offer varying levels of support for cloud cost tracking. Comparing these features is essential for selecting the right system or determining how to integrate FinOps into your existing environment.

Here’s a comparison:

| Feature | System A (Example: SAP S/4HANA) | System B (Example: Oracle NetSuite) | System C (Example: QuickBooks Enterprise) |

|---|---|---|---|

| Native Cloud Cost Integration | Limited, requires third-party integrations or custom development. | Some integration through add-ons or custom fields, but generally requires manual effort. | Generally no native integration; requires significant manual effort or third-party solutions. |

| Cost Allocation Capabilities | Strong cost center and project accounting features, allowing allocation of cloud costs. | Robust cost allocation capabilities through dimensions and custom fields. | Basic cost allocation, limited for complex cloud environments. |

| Reporting Flexibility | Highly customizable reporting with advanced analytics tools. | Good reporting capabilities, but may require add-ons for detailed cloud cost analysis. | Limited reporting capabilities, requiring manual data manipulation for cloud cost analysis. |

| API Integration | Extensive API support for integrating with cloud providers and FinOps tools. | API support available, but integration complexity may vary. | Limited API support, potentially restricting integration options. |

| Scalability | Highly scalable, suitable for large enterprises with complex cloud environments. | Scalable for mid-sized businesses, with potential limitations for very large cloud deployments. | Scalability limitations, potentially challenging for large-scale cloud cost tracking. |

The choice of financial system and its associated cloud cost tracking features will significantly impact the FinOps implementation strategy. Consider factors such as the complexity of your cloud environment, the level of automation required, and the desired granularity of cost reporting.

The Importance of Data Accuracy and Completeness in Financial Reporting

Data accuracy and completeness are paramount for effective financial reporting and are critical for successful FinOps. Inaccurate or incomplete data can lead to flawed cost analysis, incorrect decisions, and missed cost-saving opportunities.

Key considerations include:

- Data Source Integrity: Ensure that the data sources used for financial reporting are reliable and accurate. This includes cloud provider billing data, usage metrics, and any other relevant data.

- Data Validation: Implement data validation checks to identify and correct errors in the data. This may involve automated checks and manual reviews.

- Data Transformation: Properly transform and map data from different sources to ensure consistency and compatibility with your financial systems.

- Timeliness: Ensure that data is available in a timely manner to support real-time cost monitoring and analysis. Delays in data availability can hinder proactive cost management.

- Data Governance: Establish clear data governance policies and procedures to ensure data quality and consistency across the organization.

- Regular Audits: Conduct regular audits of your financial data to identify and address any data quality issues.

Accurate and complete data enables informed decision-making, facilitates accurate cost allocation, and provides a reliable basis for identifying and implementing cost-saving initiatives. Inaccurate data can lead to significant financial losses and undermine the credibility of your FinOps efforts.

Checklist for Evaluating a Financial System’s Suitability for FinOps Integration

Evaluating a financial system’s suitability for FinOps integration requires a structured approach. Use this checklist to assess your current system or evaluate potential new systems.

The checklist includes the following:

- Cloud Cost Data Integration:

- Does the system offer native integration with cloud providers (e.g., AWS, Azure, GCP)?

- Does the system support importing cloud cost data from other sources?

- Does the system support automated data ingestion and transformation?

- Cost Allocation:

- Does the system support cost allocation to cost centers, projects, or other relevant dimensions?

- Can costs be allocated based on usage, resource type, or other criteria?

- Does the system allow for flexible cost allocation rules?

- Reporting and Analytics:

- Does the system offer pre-built reports for cloud cost analysis?

- Can custom reports be created to track specific cloud cost metrics?

- Does the system integrate with business intelligence (BI) tools for advanced analytics?

- Automation and API Integration:

- Does the system offer APIs for automating data integration and reporting?

- Can the system be integrated with FinOps tools and other relevant systems?

- Does the system support automated cost optimization recommendations?

- Scalability and Performance:

- Can the system handle the volume of cloud cost data generated by your environment?

- Does the system provide acceptable performance for reporting and analysis?

- Is the system scalable to accommodate future growth in cloud usage?

- Data Security and Compliance:

- Does the system meet your organization’s security and compliance requirements?

- Are data access controls and audit trails in place?

- User Experience and Ease of Use:

- Is the system user-friendly and easy to navigate?

- Does the system provide adequate training and support?

This checklist provides a framework for assessing a financial system’s suitability for FinOps. The specific requirements will vary depending on your organization’s cloud environment, business needs, and FinOps maturity level.

Planning the FinOps Integration Strategy

Successfully integrating FinOps with financial systems requires a well-defined strategy. This involves a structured approach to ensure a smooth transition, minimize risks, and maximize the benefits of FinOps. A comprehensive plan considers all aspects, from stakeholder involvement to project timelines, setting the stage for effective cloud cost management and optimization.

Step-by-Step Process for Planning a FinOps Integration Project

The following steps provide a structured framework for planning a FinOps integration project. This process is iterative and may require adjustments based on the specific organizational context and existing infrastructure.

- Define Project Scope and Objectives: Clearly articulate the goals of the FinOps integration. This includes identifying specific cost optimization targets, desired levels of automation, and the scope of the financial systems to be integrated. For instance, an objective might be to reduce cloud spending by 15% within the next year or automate the allocation of cloud costs to specific business units.

- Identify and Engage Stakeholders: Determine the key individuals and teams involved in the project. This includes finance, engineering, operations, and executive leadership. Establish clear communication channels and ensure stakeholder buy-in from the outset.

- Assess Current State and Gaps: Review the existing financial systems and cloud infrastructure. Identify any gaps in data visibility, reporting capabilities, and automation processes. For example, if the current system lacks granular cost allocation capabilities, this becomes a key gap to address.

- Select FinOps Tools and Platforms: Evaluate and choose the appropriate FinOps tools and platforms to support the integration. This could involve cloud provider native tools, third-party FinOps platforms, or a combination of solutions. Consider factors like scalability, integration capabilities, and ease of use.

- Design the Integration Architecture: Develop a detailed architecture plan outlining how the FinOps tools will interact with the financial systems and cloud infrastructure. This includes data flow diagrams, API integrations, and data transformation processes.

- Develop a Detailed Implementation Plan: Create a comprehensive implementation plan that includes specific tasks, timelines, and resource allocation. This plan should break down the integration into manageable phases, with clear milestones for each phase.

- Test and Validate: Thoroughly test the integration to ensure data accuracy, system stability, and performance. Conduct user acceptance testing (UAT) to validate the integration from the perspective of end-users.

- Deploy and Monitor: Deploy the integrated system and continuously monitor its performance. Track key metrics, such as cost savings, automation rates, and user satisfaction. Establish a feedback loop to identify areas for improvement.

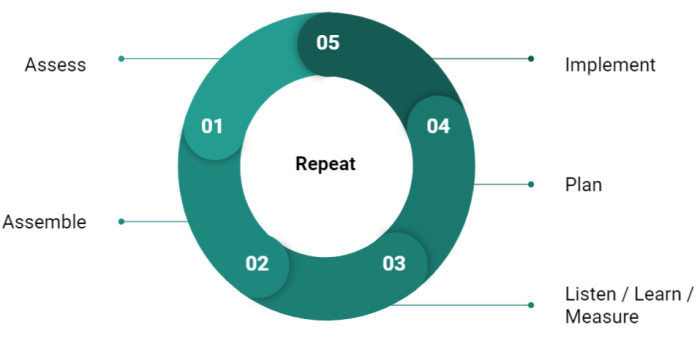

- Iterate and Optimize: FinOps is an ongoing process. Continuously analyze the performance of the integrated system and make adjustments as needed. This may involve refining cost allocation rules, optimizing cloud resource utilization, or implementing new automation features.

Key Stakeholders Involved in the Integration Process and Their Responsibilities

Successful FinOps integration depends on the active participation and collaboration of various stakeholders. Each stakeholder plays a crucial role, and their responsibilities must be clearly defined.

- Executive Sponsor: Provides overall direction and support for the FinOps initiative. They ensure alignment with organizational goals and allocate necessary resources.

- Finance Team: Responsible for financial planning, budgeting, and cost reporting. They work with the FinOps team to establish cost allocation rules, analyze spending patterns, and generate financial reports.

- Engineering/DevOps Team: Responsible for cloud infrastructure management and application development. They implement cost optimization strategies, monitor resource utilization, and automate cloud operations.

- IT Operations Team: Manages the underlying infrastructure and supports the day-to-day operations of the IT environment. They are responsible for the implementation and management of FinOps tools and platforms.

- FinOps Team (or FinOps Practitioner): Leads the FinOps initiative, coordinates activities across different teams, and ensures that the FinOps principles are implemented effectively. They are responsible for data analysis, reporting, and cost optimization.

- Cloud Provider(s): Provide cloud infrastructure and services. They offer tools and APIs that facilitate cost tracking, resource management, and optimization. Their responsibilities also include providing support and guidance to the FinOps team.

Risk Assessment Framework for Potential Challenges During Integration

Identifying and mitigating potential risks is crucial for a successful FinOps integration. A risk assessment framework helps proactively address challenges that may arise during the project.

- Data Accuracy and Integrity: This risk involves potential issues with the accuracy and consistency of data transferred between FinOps tools and financial systems.

Mitigation: Implement robust data validation processes, establish clear data governance policies, and conduct regular data audits.

- Integration Complexity: This risk stems from the complexity of integrating FinOps tools with existing financial systems.

Mitigation: Simplify the integration architecture, use standardized APIs, and adopt a phased approach to implementation.

- Stakeholder Resistance: Resistance from stakeholders can impede the integration process.

Mitigation: Proactively engage stakeholders, communicate the benefits of FinOps, and provide training and support.

- Technical Challenges: Technical issues, such as API incompatibilities or system downtime, can disrupt the integration.

Mitigation: Conduct thorough testing, use robust error handling mechanisms, and establish backup and recovery procedures.

- Security Vulnerabilities: Data breaches and security vulnerabilities can compromise sensitive financial data.

Mitigation: Implement strong security measures, including encryption, access controls, and regular security audits.

- Lack of Skills and Expertise: Insufficient skills and expertise within the team can hinder the integration process.

Mitigation: Provide training, hire experienced professionals, or partner with external consultants.

- Cost Overruns: Unexpected costs can exceed the project budget.

Mitigation: Develop a detailed budget, track expenses closely, and regularly review the project scope.

Project Timeline with Key Milestones for the Integration

A well-defined project timeline provides a roadmap for the FinOps integration, ensuring that the project stays on track and achieves its objectives. The timeline should include key milestones and deadlines.

- Phase 1: Planning and Assessment (2-4 weeks):

- Milestone 1: Define Project Scope and Objectives.

- Milestone 2: Identify and Engage Stakeholders.

- Milestone 3: Assess Current State and Gaps.

- Phase 2: Tool Selection and Design (4-6 weeks):

- Milestone 4: Select FinOps Tools and Platforms.

- Milestone 5: Design the Integration Architecture.

- Milestone 6: Develop a Detailed Implementation Plan.

- Phase 3: Implementation and Testing (8-12 weeks):

- Milestone 7: Implement the Integration.

- Milestone 8: Test and Validate the Integration.

- Milestone 9: User Acceptance Testing (UAT) Completion.

- Phase 4: Deployment and Optimization (Ongoing):

- Milestone 10: Deploy the Integrated System.

- Milestone 11: Monitor and Analyze Performance.

- Milestone 12: Iterate and Optimize.

Choosing the Right FinOps Tools

Selecting the appropriate FinOps tools is crucial for effectively managing cloud costs and optimizing resource utilization. This process involves evaluating various options, considering organizational needs, and understanding the role of cloud provider native tools. A well-chosen toolset empowers teams to gain visibility, allocate costs accurately, and make data-driven decisions regarding cloud spending.

Comparing FinOps Tools

The FinOps landscape offers a diverse range of tools, each with its strengths and weaknesses. Understanding the features, pricing models, and integrations of these tools is essential for making an informed decision. Below is a comparison table of some popular FinOps tools.

| Tool | Key Features | Pricing | Integrations |

|---|---|---|---|

| CloudHealth by VMware | Cost optimization, resource utilization analysis, governance and policy enforcement, reporting and dashboards, automated recommendations. | Subscription-based, custom pricing based on cloud spend and features. | AWS, Azure, Google Cloud, VMware. Integrates with various ITSM and DevOps tools. |

| Apptio Cloudability | Cost tracking and allocation, anomaly detection, forecasting, rightsizing recommendations, automated reporting, chargeback and showback. | Subscription-based, custom pricing based on cloud spend and features. | AWS, Azure, Google Cloud. Integrates with various business intelligence and financial systems. |

| Kubecost | Cost monitoring and optimization for Kubernetes environments, real-time cost allocation by namespace, deployment, and pod, cost anomaly detection, budget alerts. | Open-source (free core features), paid options for enterprise features and support. | Kubernetes, AWS, Azure, Google Cloud. Integrates with Prometheus and Grafana. |

| Spot by NetApp | Automated cloud resource optimization, cost-aware workload scheduling, spot instance management, cost analytics and reporting, automated right sizing. | Pay-as-you-go, based on savings achieved. | AWS, Azure, Google Cloud. Integrates with CI/CD pipelines and other DevOps tools. |

Selecting Appropriate FinOps Tools Based on Organizational Needs

Choosing the right FinOps tools depends on several factors, including the size of the organization, the complexity of the cloud environment, and the specific goals of the FinOps initiative. Consider these aspects:

- Cloud Provider(s): Ensure the tool supports your primary cloud provider(s). Some tools are multi-cloud, while others focus on a single provider.

- Features Required: Identify the key features needed, such as cost tracking, anomaly detection, resource optimization, and reporting. Prioritize features that align with your organization’s most pressing needs.

- Integration Capabilities: Consider how well the tool integrates with existing systems, such as financial systems, billing platforms, and DevOps tools. Seamless integration simplifies data flow and reporting.

- Pricing Model: Evaluate the pricing model and ensure it aligns with your budget and cloud spending. Consider both the initial cost and ongoing maintenance costs.

- Ease of Use: Choose a tool with a user-friendly interface and intuitive features. This will facilitate adoption and enable teams to quickly gain insights.

- Scalability: Ensure the tool can scale to accommodate future growth in cloud usage and complexity.

- Support and Documentation: Look for tools with comprehensive documentation, responsive customer support, and a strong community.

The Role of Cloud Provider Native Tools in FinOps Implementation

Cloud providers offer native tools that provide valuable insights into cloud costs and resource utilization. These tools often serve as a foundation for FinOps implementation, offering core functionalities such as cost monitoring, billing analysis, and resource optimization recommendations.

- AWS: AWS Cost Explorer, AWS Budgets, AWS Trusted Advisor. These tools offer cost tracking, budget management, and recommendations for optimizing resource utilization.

- Azure: Azure Cost Management + Billing. Provides cost analysis, budget alerts, and recommendations for right-sizing resources.

- Google Cloud: Google Cloud Billing, Google Cloud Cost Management. These tools offer cost tracking, budgeting, and cost optimization recommendations.

Leveraging these native tools is essential for several reasons:

- Cost-Effectiveness: Native tools are often included in your cloud subscription, reducing the need for additional investments in third-party tools.

- Deep Integration: Native tools are deeply integrated with the cloud provider’s services, providing accurate and up-to-date information.

- Immediate Access: Native tools provide immediate access to cost and usage data, enabling quick insights and decision-making.

- Foundation for Advanced Tools: Native tools can serve as a data source for more advanced FinOps tools, providing a comprehensive view of cloud costs.

Examples of Successful FinOps Tool Implementations

Various industries have successfully implemented FinOps tools to optimize cloud spending and improve efficiency.

- E-commerce: An e-commerce company used CloudHealth to identify and eliminate idle resources, resulting in a 15% reduction in monthly cloud costs. The company also used the tool to establish cost allocation policies, enabling better chargeback and showback.

- Financial Services: A financial services firm implemented Apptio Cloudability to gain granular visibility into cloud spending. The firm utilized the tool’s anomaly detection capabilities to identify unexpected cost spikes and took corrective actions, resulting in improved budget predictability.

- Technology Startup: A technology startup leveraged Kubecost to monitor and optimize Kubernetes costs. By implementing cost-aware scheduling and resource requests, the startup reduced its Kubernetes infrastructure costs by 20%.

- Media and Entertainment: A media company used Spot by NetApp to automate its cloud resource optimization. By leveraging spot instances and automated right-sizing, the company achieved significant cost savings while maintaining application performance.

Data Collection and Preparation for FinOps

Data collection and preparation are crucial for successful FinOps implementation. Accurate and reliable data forms the foundation for cost optimization, forecasting, and informed decision-making. This section details the processes involved in gathering, cleaning, transforming, and ensuring the quality of data essential for FinOps.

Collecting Cost and Usage Data from Cloud Providers

Cloud providers offer various methods for accessing cost and usage data. These methods vary in their complexity and the level of detail provided. Understanding these options is vital for selecting the most appropriate approach for your FinOps needs.

- Cloud Provider APIs: Cloud providers like AWS, Azure, and Google Cloud offer APIs (Application Programming Interfaces) that allow programmatic access to cost and usage data. These APIs typically provide granular details on resource consumption, costs, and associated metadata. For example, the AWS Cost Explorer API provides detailed cost and usage information. Using APIs offers the most flexibility and control over data retrieval.

- Cloud Provider Reporting Services: Cloud providers also offer reporting services, such as AWS Cost and Usage Reports (CUR), Azure Cost Management + Billing data export, and Google Cloud Billing export to BigQuery. These services typically provide pre-formatted reports in various formats (e.g., CSV, JSON) that can be easily integrated into FinOps tools or data warehouses. CUR, for instance, delivers comprehensive cost and usage data in a structured format, often including resource tags, which is useful for cost allocation.

- Cloud Provider Dashboards and User Interfaces: Cloud provider consoles offer dashboards and user interfaces for visualizing cost and usage data. While these interfaces are useful for initial exploration and ad-hoc analysis, they are not ideal for automated data collection. Manual extraction of data from these interfaces is time-consuming and prone to errors.

- Third-Party FinOps Tools: Many third-party FinOps tools integrate directly with cloud provider APIs and reporting services. These tools automate data collection and provide pre-built dashboards and analytics. They often simplify the data ingestion process and offer additional features like cost anomaly detection and recommendation engines.

Cleaning and Transforming Data for FinOps Analysis

Raw data from cloud providers often requires cleaning and transformation before it can be effectively used for FinOps analysis. This process involves standardizing formats, correcting errors, and enriching data to ensure accuracy and consistency.

- Data Cleaning: Data cleaning involves identifying and correcting errors, inconsistencies, and missing values. This may include:

- Removing duplicate records.

- Correcting incorrect data types (e.g., converting strings to numbers).

- Handling missing values (e.g., replacing them with default values or removing incomplete records).

- Standardizing date and time formats.

- Data Transformation: Data transformation involves converting raw data into a format suitable for analysis. This may include:

- Aggregating data at different levels of granularity (e.g., daily, weekly, monthly).

- Calculating derived metrics (e.g., cost per unit, utilization rates).

- Creating new fields based on existing data (e.g., resource tags for cost allocation).

- Standardizing units of measure.

- Data Enrichment: Data enrichment involves adding context to the data to improve its usability. This may include:

- Adding resource tags to untagged resources.

- Mapping resource IDs to business units or applications.

- Linking cost data to other data sources (e.g., CMDB, application performance monitoring data).

- Tools for Data Cleaning and Transformation: Tools such as Python with libraries like Pandas, ETL (Extract, Transform, Load) tools (e.g., Apache NiFi, Apache Airflow), and cloud-specific data processing services (e.g., AWS Glue, Azure Data Factory, Google Cloud Dataflow) can be used for data cleaning and transformation.

Procedure for Automating Data Ingestion from Various Sources

Automating data ingestion is critical for ensuring that FinOps processes have access to timely and accurate data. A well-defined procedure simplifies data collection from multiple sources.

- Identify Data Sources: Determine all sources of cost and usage data, including cloud providers, on-premises infrastructure, and third-party services.

- Choose an Automation Method: Select an automation method based on the data source and desired level of automation. Options include:

- API-based Ingestion: Use APIs to directly retrieve data from cloud providers and other sources. This method provides the most control and flexibility.

- File-based Ingestion: Automatically download reports (e.g., CSV, JSON) from cloud providers or other sources.

- Database-based Ingestion: Extract data directly from databases.

- Develop Data Pipelines: Create data pipelines to automate the process of extracting, transforming, and loading data. These pipelines typically involve the following steps:

- Extraction: Retrieve data from the source.

- Transformation: Clean and transform the data.

- Loading: Load the transformed data into a data warehouse or FinOps platform.

- Schedule Data Ingestion: Schedule the data pipelines to run automatically at regular intervals (e.g., daily, hourly) to ensure data is up-to-date.

- Monitor Data Ingestion: Implement monitoring to track the performance of data pipelines and identify any errors or issues. Set up alerts to notify stakeholders of any failures.

Best Practices for Ensuring Data Quality and Accuracy in FinOps

Maintaining data quality and accuracy is paramount for the success of FinOps initiatives. Implementing these best practices helps ensure that the data used for cost optimization and decision-making is reliable.

- Data Validation: Implement data validation checks at various stages of the data pipeline to ensure data accuracy. This may include:

- Validating data types.

- Checking for missing values.

- Verifying data ranges.

- Comparing data against known values or benchmarks.

- Data Governance: Establish data governance policies and procedures to define data ownership, data quality standards, and data access controls.

- Data Lineage: Track the origin and transformations of data to understand its history and ensure data integrity. This can be achieved by documenting the data pipeline and its components.

- Regular Audits: Conduct regular audits of data sources and data pipelines to identify and address any data quality issues.

- Error Handling and Alerting: Implement robust error handling mechanisms to catch and address data quality issues. Set up alerts to notify stakeholders of any data quality problems.

- Data Reconciliation: Regularly reconcile data from different sources to identify and resolve any discrepancies. This helps ensure that the data is consistent across all systems. For example, comparing the total cost reported by the cloud provider with the cost reported by the FinOps tool.

Integrating FinOps with Cost Allocation

Integrating FinOps with cost allocation is crucial for understanding and controlling cloud spending effectively. Accurate cost allocation allows businesses to pinpoint where their money is being spent, identify areas for optimization, and make informed decisions about resource allocation. This section delves into different cost allocation methods, provides a practical guide for implementation, and explores how to automate reporting within financial systems.

Cost Allocation Methods and Suitability for FinOps

Choosing the right cost allocation method is essential for successful FinOps implementation. Different methods suit various business needs and cloud environments. The selection process involves understanding the advantages and disadvantages of each method and aligning them with the organization’s structure and goals.

- Tag-Based Allocation: This method utilizes cloud provider tags to categorize resources. Tags are key-value pairs that can be applied to resources, allowing for allocation based on business units, projects, or environments.

- Suitability: Highly suitable for most FinOps implementations, especially for organizations already using tagging.

- Advantages: Relatively easy to implement, provides flexibility, and can be customized to various needs.

- Disadvantages: Relies on consistent and accurate tagging, which can be challenging to maintain.

- Resource-Based Allocation: This method allocates costs based on resource usage metrics, such as CPU time, memory, or storage.

- Suitability: Suitable for granular cost analysis and understanding resource consumption patterns.

- Advantages: Provides detailed insights into resource utilization.

- Disadvantages: Can be complex to implement and requires significant data processing.

- Business Unit Allocation: Costs are allocated to different business units based on their resource consumption.

- Suitability: Ideal for organizations that want to understand the cost of each business unit.

- Advantages: Promotes accountability and transparency across business units.

- Disadvantages: Requires a clear definition of business units and their resource usage.

- Project-Based Allocation: Costs are allocated to specific projects, allowing for cost tracking and analysis at the project level.

- Suitability: Useful for organizations that run multiple projects and need to track the cost of each project.

- Advantages: Facilitates project budgeting and cost control.

- Disadvantages: Requires associating resources with specific projects.

- Service-Based Allocation: Costs are allocated to specific services, providing insights into the cost of each service.

- Suitability: Suitable for organizations that want to understand the cost of each service offered.

- Advantages: Enables cost optimization and service performance analysis.

- Disadvantages: Requires defining and tracking service usage.

- Shared Cost Allocation: Some costs are shared across multiple units or projects.

- Suitability: Applicable for costs associated with shared resources, such as networking or centralized logging.

- Advantages: Reflects the actual cost of shared resources.

- Disadvantages: Can be complex to calculate and allocate.

Implementing Cost Allocation Based on Business Units, Projects, or Services

Implementing cost allocation involves several steps, from defining allocation rules to setting up monitoring and reporting. The specific steps depend on the chosen method and the FinOps tools used. The following provides a general guide.

- Define Allocation Rules: Establish clear rules for allocating costs. This includes identifying the business units, projects, or services and the resources associated with them.

- Implement Tagging Strategy: If using tag-based allocation, implement a consistent tagging strategy. Ensure that all resources are tagged appropriately.

- Example: Use tags like `business_unit:marketing`, `project:website-redesign`, or `service:api-gateway`.

- Configure FinOps Tools: Configure the chosen FinOps tools to collect and process cost data. Set up the tools to use the defined allocation rules and tagging strategy.

- Monitor and Validate Data: Regularly monitor cost data to ensure accuracy. Validate the data by comparing the allocated costs with the actual resource usage.

- Generate Reports: Generate reports that show the cost of each business unit, project, or service. Use the reports to identify areas for optimization.

- Iterate and Refine: Continuously refine the cost allocation process based on feedback and insights. Adjust the allocation rules and tagging strategy as needed.

Tracking and Allocating Costs Using Specific FinOps Tools

Different FinOps tools offer varying capabilities for cost allocation. Some tools integrate directly with cloud providers, while others provide more advanced features.

- AWS Cost Explorer:

- Functionality: Offers tag-based cost allocation and allows for filtering and grouping costs by tags.

- Example: Users can filter costs by the `business_unit` tag to see the cost of each business unit.

- Benefit: Provides detailed cost breakdowns and visualizations.

- Google Cloud Billing:

- Functionality: Supports cost allocation using labels and provides detailed cost reports.

- Example: Users can create reports that show the cost of each project based on labels.

- Benefit: Integrates seamlessly with Google Cloud services.

- Azure Cost Management + Billing:

- Functionality: Supports cost allocation using tags and provides cost analysis and reporting.

- Example: Users can filter costs by tags to see the cost of each resource group.

- Benefit: Offers detailed cost insights and recommendations.

- Third-Party FinOps Tools (e.g., CloudHealth, Apptio Cloudability):

- Functionality: Provide advanced cost allocation features, including support for custom allocation rules and automated reporting.

- Example: Can allocate costs based on complex criteria, such as resource usage and business metrics.

- Benefit: Offer comprehensive FinOps capabilities and integrations with multiple cloud providers.

Designing a Process for Automating Cost Allocation Reporting within Financial Systems

Automating cost allocation reporting is essential for efficiency and accuracy. The process involves integrating FinOps tools with financial systems to ensure that cost data is readily available for financial analysis.

- Data Extraction: Extract cost data from FinOps tools. This can be done through APIs or scheduled reports.

- Example: Use the AWS Cost Explorer API to extract cost data for each business unit.

- Data Transformation: Transform the cost data into a format that is compatible with financial systems. This may involve mapping cost categories to general ledger accounts.

- Example: Map the cost of EC2 instances to the “Compute” expense account.

- Data Loading: Load the transformed cost data into financial systems. This can be done through automated integrations or manual uploads.

- Example: Use an API to load the cost data into the company’s accounting software.

- Report Generation: Generate automated cost allocation reports within financial systems. These reports should show the cost of each business unit, project, or service.

- Example: Create a monthly report that shows the cost of each project.

- Automation Tools: Implement automation tools to streamline the process.

- Example: Use a scripting language like Python to automate data extraction, transformation, and loading.

- Review and Validation: Regularly review and validate the automated reports to ensure accuracy.

Implementing Cost Optimization Strategies

Implementing cost optimization strategies is a crucial step in FinOps, transforming cloud spending from a reactive expense into a proactively managed investment. This involves a continuous cycle of identifying areas for improvement, implementing changes, and measuring the impact. This section details various cost optimization strategies, provides examples of their application, and demonstrates how to track the effectiveness of these efforts.

Rightsizing Resources

Rightsizing involves matching cloud resource usage to actual demand, ensuring that resources are neither over-provisioned (leading to unnecessary costs) nor under-provisioned (leading to performance issues).

- Identifying Over-Provisioned Resources: Utilize cloud provider tools (e.g., AWS Compute Optimizer, Azure Advisor, Google Cloud Recommendations) to analyze resource utilization data. These tools provide recommendations for downsizing or consolidating resources based on historical usage patterns.

- Implementing Rightsizing: For example, a virtual machine consistently using only 20% of its CPU capacity can be downsized to a smaller instance type. Similarly, unused or idle resources (e.g., orphaned storage volumes) should be identified and terminated.

- Monitoring and Validation: After rightsizing, continuously monitor the performance of the adjusted resources. If performance degrades, consider increasing the resource size again. This iterative approach ensures optimal resource allocation.

Utilizing Reserved Instances and Committed Use Discounts

Cloud providers offer significant discounts for committing to a certain level of resource usage over a defined period. Understanding and leveraging these options is essential for cost optimization.

- Reserved Instances (RIs) and Savings Plans (AWS): RIs provide significant discounts (up to 72%) compared to on-demand pricing for reserved capacity. Savings Plans offer flexible pricing models that can reduce compute costs by up to 72% in exchange for a commitment to a consistent amount of usage (measured in dollars per hour) over a 1- or 3-year term.

- Committed Use Discounts (CUDs) (Google Cloud): CUDs offer discounts (up to 70%) for committing to use a specific amount of compute resources in a region.

- Azure Reserved Virtual Machine Instances (Azure): Azure offers discounts (up to 72%) on virtual machines when you reserve capacity for one or three years.

- Analysis and Planning: Analyze historical usage patterns to identify consistent resource needs. Calculate the potential cost savings from purchasing RIs, Savings Plans, or CUDs.

- Implementation: Purchase RIs, Savings Plans, or CUDs based on the analysis. Prioritize commitments for resources with the most consistent and predictable usage.

- Continuous Review: Regularly review RI/Savings Plan/CUD utilization and adjust commitments as needed. Ensure that commitments are not expiring without being renewed or adjusted to maximize savings.

Optimizing Storage Costs

Storage costs can be a significant component of cloud expenses. Several strategies can be employed to optimize storage costs.

- Choosing the Right Storage Tier: Cloud providers offer various storage tiers with different pricing and performance characteristics. For example, Amazon S3 provides Standard, Standard-IA (Infrequent Access), Glacier, and Glacier Deep Archive. Azure Blob Storage offers Hot, Cool, and Archive tiers. Google Cloud Storage offers Standard, Nearline, Coldline, and Archive. Selecting the appropriate tier based on data access frequency can significantly reduce costs.

For instance, infrequently accessed data should be stored in a lower-cost tier like Glacier or Archive.

- Data Lifecycle Management: Implement data lifecycle policies to automatically move data between storage tiers based on its age or access patterns. This ensures that data is stored in the most cost-effective tier.

- Deleting Unused Data: Regularly identify and delete unused or obsolete data. This includes orphaned storage volumes, backups, and temporary files.

- Data Compression: Compress data before storing it to reduce storage space and associated costs. This can be particularly effective for text-based files and log data.

Leveraging Spot Instances and Preemptible VMs

Spot Instances (AWS) and Preemptible VMs (Google Cloud) offer significantly lower prices compared to on-demand instances, but they can be terminated with short notice. Azure offers similar functionality with Spot VMs.

- Suitability for Workloads: These instance types are ideal for fault-tolerant and non-critical workloads, such as batch processing, development and testing environments, and certain types of parallel computing.

- Bidding and Automation: Implement automation to bid on Spot Instances/Preemptible VMs/Spot VMs based on your price tolerance. Design your applications to be resilient to instance terminations.

- Cost Savings Potential: Spot Instances/Preemptible VMs/Spot VMs can provide cost savings of up to 90% compared to on-demand instances.

Implementing Automation and Scaling

Automating resource management and implementing autoscaling can optimize costs by dynamically adjusting resource capacity to meet demand.

- Autoscaling: Configure autoscaling rules to automatically scale resources up or down based on metrics like CPU utilization, memory usage, or queue length. This ensures that you only pay for the resources you need.

- Automated Shutdown/Startup: Automate the shutdown of non-production environments (e.g., development, testing) during off-peak hours. This reduces costs by eliminating the need to pay for unused resources.

- Infrastructure as Code (IaC): Use IaC tools (e.g., Terraform, CloudFormation, Azure Resource Manager) to automate the provisioning and management of cloud infrastructure. This reduces manual errors and improves efficiency.

Tracking the Impact of Cost Optimization Efforts

Measuring the effectiveness of cost optimization efforts is crucial for continuous improvement. This involves establishing clear metrics and tracking them over time.

- Key Performance Indicators (KPIs): Define KPIs to measure the impact of cost optimization initiatives. Examples include:

- Cost per Unit: Measure the cost of delivering a specific unit of service (e.g., cost per transaction, cost per user).

- Cost Savings Percentage: Calculate the percentage reduction in cloud spending after implementing cost optimization measures.

- Resource Utilization: Track the utilization of resources (e.g., CPU, memory, storage) to identify areas for rightsizing.

- Cloud Spend Breakdown: Analyze the distribution of cloud spending across different services, regions, and teams.

- Monitoring and Reporting: Implement monitoring tools to track KPIs and generate regular reports. Cloud providers offer built-in cost management dashboards and reporting capabilities. Third-party FinOps tools can provide more advanced analytics and insights.

- Benchmarking: Compare your cloud spending and performance against industry benchmarks and best practices. This helps to identify areas for improvement and validate the effectiveness of your cost optimization efforts.

Report Format for Communicating Cost Optimization Results

Communicating cost optimization results effectively is essential for gaining stakeholder buy-in and ensuring continued support for FinOps initiatives.

- Executive Summary: Briefly summarize the key findings and accomplishments of the cost optimization efforts.

- Cost Savings Achieved: Quantify the cost savings achieved, including the total amount saved and the percentage reduction in cloud spending.

- Cost Optimization Initiatives: Describe the specific cost optimization initiatives implemented, such as rightsizing, RI/Savings Plan/CUD utilization, and storage optimization.

- KPI Performance: Present the performance of key KPIs, such as cost per unit, resource utilization, and cloud spend breakdown.

- Recommendations and Next Steps: Provide recommendations for future cost optimization efforts and Artikel the next steps to be taken.

- Visualizations: Include charts and graphs to visually represent the data and make it easier to understand. For example, a bar chart can be used to show the cost savings achieved by different initiatives. A pie chart can show the cloud spend breakdown.

- Timeline: Display a timeline showing the progress of cost optimization initiatives over time.

Automation and Continuous Improvement

Implementing FinOps effectively necessitates not only integrating it with your financial systems but also a commitment to automating processes and continuously refining practices. Automation streamlines operations, reduces manual effort, and allows for proactive cost management. Continuous improvement ensures that FinOps strategies adapt to evolving cloud environments and business needs.

The Role of Automation in FinOps Implementation

Automation is a cornerstone of a successful FinOps implementation, enabling efficiency, accuracy, and scalability. It allows FinOps teams to focus on strategic decision-making rather than repetitive tasks.

- Efficiency: Automating tasks like data collection, reporting, and anomaly detection frees up valuable time for FinOps practitioners. This allows them to concentrate on analyzing data, identifying cost-saving opportunities, and optimizing cloud resource utilization.

- Accuracy: Automation minimizes the risk of human error in data processing and reporting. Automated processes ensure consistent and reliable data, leading to more informed decision-making.

- Scalability: As cloud usage and complexity grow, manual processes become unsustainable. Automation allows FinOps practices to scale efficiently, handling increasing volumes of data and resources without requiring a proportional increase in manual effort.

- Proactive Cost Management: Automation enables proactive cost management by providing real-time insights and alerts. This allows teams to identify and address cost anomalies quickly, preventing unnecessary spending.

Examples of Automating Cost Reporting and Anomaly Detection

Automating cost reporting and anomaly detection are key areas where automation delivers significant value in FinOps. Implementing automated systems can provide immediate and ongoing benefits in cost control.

- Automated Cost Reporting: Implement automated systems to generate and distribute cost reports. These reports can be customized to meet the needs of various stakeholders, such as finance teams, engineering teams, and business unit leaders. For example, automate the process of pulling data from cloud provider APIs, aggregating it, and generating daily or weekly reports showing spending by service, team, or project.

These reports can be delivered via email, Slack, or other communication channels.

- Automated Anomaly Detection: Use automated anomaly detection tools to identify unusual spending patterns. These tools can be configured to monitor key metrics, such as daily or weekly cloud spend, and to alert the FinOps team when spending exceeds pre-defined thresholds or deviates from historical trends. For example, if a specific service’s cost suddenly increases by 20% without a corresponding increase in usage, an alert can be triggered, prompting investigation.

Consider using machine learning algorithms to identify anomalies more effectively.

- Example Scenario: A company uses AWS and has automated cost reporting. Their system detects a sudden spike in EC2 instance costs. The automated system flags this anomaly, and the FinOps team investigates. They discover a misconfigured EC2 instance running unnecessarily, costing the company $5,000 per month. The FinOps team corrects the configuration, saving the company a significant amount.

Strategies for Continuous Improvement in FinOps Practices

Continuous improvement in FinOps requires a proactive approach to monitoring, analyzing, and refining processes. This involves a cycle of evaluation, adjustment, and implementation.

- Regular Performance Reviews: Conduct regular reviews of FinOps performance. This involves analyzing key metrics, such as cost savings, utilization rates, and accuracy of forecasts. Identify areas where improvements can be made and track progress over time.

- Feedback Loops: Establish feedback loops to gather input from stakeholders. This includes soliciting feedback from engineering teams, finance teams, and business unit leaders. Use this feedback to identify pain points and opportunities for improvement.

- Experimentation and Iteration: Encourage experimentation and iteration. Try new strategies and tools, and be willing to adjust your approach based on the results. Continuously refine your FinOps practices based on what you learn.

- Training and Education: Provide ongoing training and education to FinOps team members and other stakeholders. This helps ensure that everyone understands the latest FinOps best practices and tools.

- Technology Evaluation: Regularly evaluate FinOps tools and technologies. As the cloud landscape evolves, new tools and features become available. Stay informed about the latest advancements and consider adopting new technologies that can improve your FinOps practices.

Framework for Regularly Reviewing and Refining FinOps Processes

A structured framework helps ensure that FinOps processes are regularly reviewed and refined. This framework should incorporate regular reviews, analysis, and adjustments.

- Define Key Metrics: Establish a set of key performance indicators (KPIs) to track the effectiveness of your FinOps practices. Examples include cost savings, utilization rates, accuracy of forecasts, and time to resolution for cost anomalies.

- Establish a Review Schedule: Set up a regular schedule for reviewing FinOps performance. This could be monthly, quarterly, or annually, depending on the complexity of your cloud environment and the pace of change.

- Data Collection and Analysis: Collect data on the defined KPIs and analyze the results. Identify trends, patterns, and areas where improvements can be made. Use data visualization tools to help with analysis.

- Feedback and Collaboration: Gather feedback from stakeholders, including engineering teams, finance teams, and business unit leaders. Facilitate collaboration to identify areas for improvement and develop solutions.

- Action Planning: Based on the analysis and feedback, create an action plan to address identified issues. This plan should include specific actions, timelines, and assigned responsibilities.

- Implementation and Monitoring: Implement the action plan and monitor the results. Track the progress of the improvements and make adjustments as needed.

- Documentation and Communication: Document the entire process, including the key metrics, review schedule, analysis results, action plans, and progress updates. Communicate the findings and recommendations to all relevant stakeholders.

- Example Cycle: A company uses a quarterly review cycle. Each quarter, they review their cost savings, identify any anomalies, and gather feedback from engineering teams. Based on their findings, they create an action plan to optimize specific services and improve resource utilization. They implement these changes and monitor the results in the following quarter.

Governance and Policy Enforcement

Establishing robust governance and policy enforcement is crucial for successful FinOps implementation. Without clear guidelines and mechanisms for monitoring and controlling cloud spending, the benefits of FinOps – cost optimization, increased efficiency, and improved predictability – can be significantly diminished. Effective governance ensures that cloud resources are utilized in a responsible and cost-effective manner, aligning with organizational goals and budgetary constraints.

Importance of Establishing Governance Policies for Cloud Spending

Governance policies for cloud spending are fundamental to FinOps success. They provide a framework for managing cloud resources, ensuring accountability, and preventing uncontrolled expenditure. Implementing these policies fosters a culture of cost awareness and helps organizations avoid common pitfalls such as shadow IT, over-provisioning, and inefficient resource utilization.

Examples of Policies Enforced Through FinOps Tools

FinOps tools are instrumental in enforcing a variety of cloud cost policies. These tools automate the monitoring and enforcement of these policies, ensuring adherence and minimizing manual intervention.

- Budget Alerts and Thresholds: FinOps tools can be configured to send alerts when spending approaches or exceeds predefined budget thresholds. This allows teams to proactively address potential cost overruns before they become significant issues. For instance, a policy might set a monthly budget for a specific application, with alerts triggered at 75%, 90%, and 100% of the budget.

- Resource Tagging and Enforcement: Policies can mandate the tagging of all cloud resources with specific metadata, such as cost centers, application owners, and environment identifiers (e.g., production, staging, development). FinOps tools can then enforce these tagging requirements, ensuring that all resources are properly categorized for accurate cost allocation and reporting.

- Right-Sizing Recommendations and Automation: Tools can provide recommendations for right-sizing cloud resources based on actual utilization patterns. Policies can be established to automatically downsize underutilized instances or delete unused resources, thereby optimizing costs. For example, a policy might automatically shut down development instances outside of working hours.

- Reserved Instance Utilization: Policies can govern the purchase and utilization of reserved instances or savings plans to maximize discounts on cloud compute resources. FinOps tools can track the utilization of these reservations and alert teams to underutilization, prompting adjustments to maximize savings.

- Spending Limits by Service or Team: Policies can set limits on spending for specific cloud services or for individual teams or departments. This helps control overall cloud costs and prevents excessive spending in certain areas. A policy might restrict a development team’s spending on a specific database service to a predefined amount per month.

Methods for Monitoring and Enforcing Cloud Cost Policies

Effective monitoring and enforcement of cloud cost policies involve a combination of automated tools, regular reporting, and proactive communication.

- Automated Monitoring and Alerting: FinOps tools continuously monitor cloud spending against established policies and automatically generate alerts when violations occur. These alerts can be sent to relevant stakeholders, such as application owners, finance teams, and IT operations.

- Regular Reporting and Dashboards: FinOps platforms provide dashboards and reports that visualize cloud spending trends, policy compliance, and cost optimization opportunities. These reports should be accessible to all stakeholders and updated regularly to ensure transparency and accountability.

- Policy Enforcement Mechanisms: FinOps tools can enforce policies through various mechanisms, including automated resource provisioning, resource tagging validation, and the blocking of non-compliant resource deployments.

- Integration with CI/CD Pipelines: Integrating FinOps tools with CI/CD pipelines allows for automated cost checks and policy enforcement during the software development lifecycle. This helps prevent costly deployments and ensures that new resources adhere to established policies.

- Continuous Improvement and Feedback Loops: Regularly review and refine cloud cost policies based on monitoring data, feedback from stakeholders, and evolving business needs. Establish a feedback loop to identify areas for improvement and adjust policies accordingly.

Template for Communicating Cloud Cost Policies to Stakeholders

Communicating cloud cost policies effectively is essential for fostering buy-in and ensuring compliance across the organization. The following template provides a framework for communicating these policies to stakeholders.

Subject: Cloud Cost Management Policy – [Organization Name]

Introduction:

This document Artikels the cloud cost management policies for [Organization Name]. These policies are designed to ensure responsible and cost-effective utilization of cloud resources, aligning with our strategic goals and budgetary constraints.

Policy Objectives:

- Optimize cloud spending and minimize unnecessary costs.

- Improve transparency and accountability for cloud resource usage.

- Ensure consistent application of cloud cost management practices across the organization.

- Foster a culture of cost awareness and responsibility.

Key Policies:

- Budgeting and Forecasting:

- All projects and applications must have defined cloud budgets.

- Budgets will be reviewed and adjusted [frequency – e.g., quarterly, annually].

- Spending forecasts will be provided to the finance team.

- Resource Tagging:

- All cloud resources must be tagged with the following information: [list of required tags, e.g., cost center, application owner, environment].

- Tagging will be validated during resource provisioning.

- Resource Utilization:

- Regularly review resource utilization and right-size or terminate underutilized resources.

- Implement automated resource scaling where appropriate.

- Cost Optimization:

- Utilize reserved instances or savings plans where appropriate to maximize cost savings.

- Optimize storage costs by selecting appropriate storage tiers.

- Regularly review and optimize cloud service configurations.

- Monitoring and Alerting:

- Cloud spending will be monitored using [FinOps tool name].

- Alerts will be triggered when spending exceeds predefined thresholds.

- Regular cost reports will be provided to stakeholders.

Roles and Responsibilities:

- [Role 1, e.g., Application Owners]: Responsible for managing the cloud costs associated with their applications, including budgeting, resource optimization, and responding to alerts.

- [Role 2, e.g., Finance Team]: Responsible for overall cloud cost management, budget tracking, and reporting.

- [Role 3, e.g., IT Operations]: Responsible for implementing and maintaining FinOps tools and processes, as well as providing technical support.

Enforcement:

Non-compliance with these policies may result in [consequences, e.g., budget restrictions, project delays, corrective action].

Review and Updates:

This policy will be reviewed and updated [frequency – e.g., annually, quarterly] or as needed.

Contact:

For questions or clarifications regarding this policy, please contact [contact person or department].

Reporting and Visualization for FinOps

Effective FinOps relies heavily on clear and actionable reporting and visualization. This allows stakeholders to understand cloud spending, identify areas for optimization, and make informed decisions. Presenting complex financial data in an easily digestible format is crucial for driving cost efficiency and accountability across the organization.

Designing a Dashboard to Visualize Cloud Cost Data

Creating a well-designed dashboard is fundamental for providing a real-time view of cloud spending. The dashboard should be easily accessible and customizable to meet the needs of various stakeholders, from engineers to finance teams.

The following layout presents a basic example, designed for four responsive columns:

Column 1: Overview & Summary

- Total Cloud Spend: A large, prominent display of the current month’s total cloud expenditure.

- Month-over-Month Comparison: A visual representation (e.g., a bar chart) comparing the current month’s spending to the previous month.

- Budget vs. Actual: A gauge or progress bar indicating how cloud spending aligns with the allocated budget.

Column 2: Cost Breakdown by Service

- Top Spending Services: A pie chart or bar graph displaying the services consuming the most resources and their respective costs.

- Service Trend: A line graph showing the cost trends for the top 3-5 services over time.

Column 3: Cost Breakdown by Team/Project

- Team/Project Spend: A table or bar chart displaying the cloud spending for each team or project, allowing for chargeback and showback analysis.

- Anomaly Detection: A visual alert or indicator highlighting any unusual spending patterns or spikes in costs.

Column 4: Optimization Opportunities

- Recommendations: A list of actionable recommendations for cost optimization, such as rightsizing instances, utilizing reserved instances, or identifying idle resources.

- Savings Potential: An estimate of potential cost savings based on the recommendations.

This structure allows for a comprehensive overview of cloud costs, enabling informed decision-making and effective FinOps management.

Key Metrics to Track for Effective FinOps Management

Tracking the right metrics is essential for monitoring and optimizing cloud spending. These metrics provide insights into cost trends, performance, and areas for improvement.

The following are key metrics to monitor:

- Cost: The total cost of cloud services, including compute, storage, networking, and other resources. This is the fundamental metric to track.

- Cost per Unit: This metric helps to assess the cost-effectiveness of specific services. For example, the cost per GB of storage or the cost per CPU hour.

- Cost Allocation: This involves breaking down costs by teams, projects, or business units. It helps to understand where the money is being spent and who is responsible for the costs.

- Utilization: Measures how efficiently cloud resources are being used. High utilization indicates efficient resource allocation, while low utilization can signal waste.

- Resource Efficiency: This metric combines cost and utilization to assess how well resources are being used. For example, comparing the cost per transaction with resource utilization.

- Reserved Instance Coverage: This metric shows the percentage of compute capacity covered by reserved instances. Higher coverage often indicates lower costs.

- Savings: The actual amount of money saved through optimization efforts, such as rightsizing, reserved instances, and automation.

- Budget Variance: The difference between the budgeted and actual spending. This helps to identify areas where spending is exceeding the budget.

- Cost per Customer/User: Relevant for businesses that can tie cloud costs directly to customer or user activity.

- Anomaly Detection Alerts: Number of alerts generated by the FinOps platform, indicating potential cost anomalies or unexpected spending patterns.

These metrics provide a comprehensive view of cloud spending and performance, allowing for informed decision-making and proactive cost optimization.

Examples of Reports That Can Be Generated to Communicate Cost Insights

Generating insightful reports is crucial for communicating cloud cost data to various stakeholders. Reports should be tailored to the specific needs of each audience, from executives to engineers.

Here are examples of reports that can be generated:

- Executive Summary: A high-level overview of cloud spending, including total cost, month-over-month changes, budget variance, and key optimization recommendations. This report is typically presented to senior management.

- Cost Breakdown Report: A detailed breakdown of cloud spending by service, team, project, and resource type. This report helps to identify cost drivers and areas for optimization.

- Utilization Report: A report that shows resource utilization metrics, such as CPU utilization, memory utilization, and storage capacity. This report helps to identify underutilized resources and opportunities for rightsizing.

- Optimization Recommendation Report: A report that lists specific recommendations for cost optimization, such as rightsizing instances, utilizing reserved instances, and deleting unused resources. This report includes estimated savings and the impact of each recommendation.

- Budget vs. Actual Report: A report that compares actual cloud spending to the allocated budget, highlighting any variances and the reasons behind them. This report is essential for budget management and financial planning.

- Anomaly Detection Report: A report that highlights unusual spending patterns or spikes in costs, triggering alerts for further investigation.

- Chargeback/Showback Report: A report that allocates cloud costs to specific teams or projects, allowing for chargeback and showback analysis.

- Trend Analysis Report: A report that shows cost trends over time, helping to identify patterns and predict future spending.

These reports provide actionable insights into cloud spending, enabling informed decision-making and effective cost management.

Demonstrating How to Use Data Visualization Tools to Present FinOps Data Effectively

Data visualization tools are essential for presenting FinOps data in a clear and understandable manner. These tools allow for the creation of dashboards, charts, and graphs that highlight key trends and insights.

Here’s how to effectively use data visualization tools:

- Choose the Right Tool: Select a data visualization tool that aligns with your needs and technical capabilities. Popular options include:

- Cloud Provider Native Tools: AWS Cost Explorer, Google Cloud Cost Management, Azure Cost Management.

- Third-Party FinOps Platforms: CloudHealth, Apptio, CloudZero, Kubecost.

- General-Purpose Visualization Tools: Tableau, Power BI, Grafana.

- Select Appropriate Chart Types: Choose the chart types that best represent the data and the insights you want to convey. Examples:

- Bar Charts: For comparing costs across different services, teams, or projects.

- Line Charts: For showing cost trends over time.

- Pie Charts: For visualizing the proportion of costs allocated to different services.

- Gauge Charts: For displaying budget vs. actual spending.

- Use Clear and Concise Labels: Label charts and graphs clearly and concisely. Use descriptive titles, axis labels, and legends to ensure that the data is easy to understand.

- Highlight Key Insights: Use color-coding, annotations, and other visual cues to highlight key insights and trends. For example, use red to indicate cost overruns or green to indicate cost savings.

- Provide Drill-Down Capabilities: Allow users to drill down into the data to explore specific details. This can be achieved by adding filters, interactive elements, and the ability to click on data points to view more information.

- Automate Reporting: Automate the generation and distribution of reports and dashboards. This ensures that stakeholders have access to the latest data without manual effort.

- Regularly Review and Update Dashboards: Review and update dashboards regularly to ensure that they are still relevant and providing the necessary insights. Adapt the visualizations as the business evolves and cloud usage changes.

By following these guidelines, you can effectively use data visualization tools to communicate FinOps data, drive cost optimization, and empower stakeholders to make informed decisions. For example, a line chart showing monthly spending trends, with clear labels for each service and annotations highlighting significant events (e.g., instance rightsizing, implementing reserved instances), can immediately illustrate the impact of optimization efforts.

Case Studies: Real-World FinOps Integration

Understanding how other organizations have successfully integrated FinOps can provide invaluable insights. Examining real-world examples reveals the practical application of FinOps principles, the challenges encountered, and the benefits achieved. These case studies illustrate the diverse approaches to FinOps and offer guidance for organizations embarking on their own FinOps journey.

Case Study 1: Cloud-Native E-commerce Platform