Implementing an IT chargeback model for cloud costs is no longer a luxury, but a necessity for organizations seeking financial control and optimized resource allocation in the cloud. This comprehensive guide delves into the core principles, practical methodologies, and essential tools required to successfully implement a chargeback system, ensuring transparency and accountability across your cloud environment. It moves beyond simple cost tracking, offering a roadmap to empower your business units with the information they need to make informed decisions about cloud spending.

This guide will cover key aspects such as defining chargeback versus showback, choosing the right methodologies, allocating costs effectively, selecting appropriate tools, establishing clear policies, and optimizing your model over time. Whether you’re new to chargeback or looking to refine an existing system, this resource provides the insights and actionable steps needed to transform your cloud cost management strategy. It is a good reference to assist you to understand more deeply and clearly.

Defining IT Chargeback

IT chargeback models are essential for managing cloud costs effectively. They provide a mechanism for allocating the expenses associated with cloud services to the business units that consume them. This fosters accountability and encourages responsible cloud resource utilization.

Fundamental Principles of IT Chargeback

The core of an IT chargeback model lies in its ability to link cloud resource consumption to specific business activities. This is achieved through a systematic approach that includes cost tracking, allocation, and reporting. The goal is to provide transparency into cloud spending and empower business units to make informed decisions about their cloud usage.

Chargeback Versus Showback

Chargeback and showback are often used in the context of cloud cost management, but they serve different purposes.

Chargeback involves actually billing business units for the cloud resources they consume.

This billing process typically includes generating invoices and transferring funds.

Showback, on the other hand, is a reporting mechanism that provides visibility into cloud costs without actually billing the business units.

Showback allows business units to see how much they are spending on cloud resources, which can help them to optimize their usage and reduce costs. The primary difference is the financial transaction: chargeback involves money changing hands, while showback does not.

Key Stakeholders in IT Chargeback

Several stakeholders are involved in the successful implementation and operation of an IT chargeback model. Their roles and responsibilities are crucial for ensuring the model’s effectiveness and fairness.

- IT Department: The IT department is responsible for implementing and managing the chargeback model. This includes setting up the cost tracking mechanisms, defining the allocation rules, generating reports, and providing support to the business units. The IT department also needs to maintain the underlying infrastructure and tools that enable the chargeback process.

- Finance Department: The finance department plays a critical role in the chargeback process. They are responsible for setting the pricing models, processing the invoices, and ensuring that the chargeback process aligns with the company’s financial policies. They also work with IT to reconcile cloud spending with the budget and track the overall financial performance.

- Business Units: Business units are the consumers of cloud resources and the recipients of the chargeback invoices. They are responsible for understanding their cloud usage, optimizing their resource consumption, and managing their budgets accordingly. Business units should work with IT and finance to understand the cost allocation model and address any concerns they may have. They are also responsible for reviewing the chargeback reports and identifying opportunities for cost savings.

Benefits and Challenges of Implementing Chargeback

Implementing an IT chargeback model can significantly impact an organization’s cloud spending and resource management. While the advantages are numerous, organizations must also be prepared to address the inherent challenges. A successful implementation requires careful planning, execution, and ongoing optimization to maximize the benefits and mitigate potential drawbacks.

Advantages of Implementing Chargeback

The implementation of an IT chargeback model offers several key advantages that can transform how an organization manages its cloud resources and finances. These benefits often lead to improved cost efficiency, enhanced accountability, and better decision-making.

- Improved Cost Transparency: Chargeback models provide a clear and detailed view of cloud spending, allowing departments to understand their consumption patterns and associated costs. This transparency helps identify areas where costs can be optimized. For instance, a marketing department might discover that it is over-provisioning resources for a seasonal campaign and can adjust its usage accordingly, resulting in cost savings.

- Enhanced Cost Control: By associating costs with specific departments or projects, chargeback models empower teams to take ownership of their cloud spending. This promotes responsible resource utilization and encourages teams to seek cost-effective solutions. For example, development teams might be incentivized to select more cost-efficient cloud services or optimize their code to reduce resource consumption.

- Increased Accountability: Chargeback models create a direct link between resource consumption and departmental budgets. This accountability encourages departments to use resources judiciously and justify their spending. This can lead to more informed decision-making regarding cloud resource allocation and utilization.

- Optimized Resource Allocation: With a clear understanding of cloud spending, organizations can optimize resource allocation across different departments and projects. This can involve reallocating resources from underutilized areas to those with higher demand, ensuring that resources are used efficiently and effectively.

- Better Budgeting and Forecasting: Chargeback data provides valuable insights into cloud spending patterns, enabling organizations to improve their budgeting and forecasting accuracy. This allows for more informed financial planning and resource allocation decisions. For example, a company can use historical chargeback data to predict future cloud costs and allocate budget accordingly.

- Fostering a Culture of Cost Awareness: Implementing a chargeback model can cultivate a culture of cost awareness throughout the organization. This encourages employees at all levels to consider the financial implications of their resource usage, leading to more responsible cloud spending habits.

Challenges of Implementing Chargeback

While the benefits of implementing an IT chargeback model are substantial, organizations must also be aware of the potential challenges. Successfully navigating these challenges is crucial for a smooth implementation and long-term success.

- Complexity of Implementation: Implementing a chargeback model can be complex, requiring careful planning, configuration, and integration with existing IT systems. This can involve defining chargeback rates, setting up billing processes, and integrating with cloud service providers.

- Data Collection and Accuracy: Accurate data collection is essential for a successful chargeback model. Organizations must ensure that they have the necessary tools and processes in place to collect and track cloud resource usage data accurately. Inaccurate data can lead to unfair charges and erode trust in the model.

- Defining Chargeback Rates: Determining appropriate chargeback rates can be challenging. Rates should be fair, transparent, and reflect the actual cost of cloud resources. Setting rates too high can discourage adoption, while setting them too low may not cover costs.

- Resistance to Change: Implementing a chargeback model can be met with resistance from departments or teams that are accustomed to free or unlimited access to cloud resources. Organizations must address this resistance by clearly communicating the benefits of the model and providing adequate training and support.

- Administrative Overhead: Managing a chargeback model can create administrative overhead, including billing, reporting, and dispute resolution. Organizations must allocate sufficient resources to manage these tasks effectively.

- Integration with Existing Systems: Integrating the chargeback model with existing financial and IT systems can be complex. This may require custom development or the use of specialized chargeback software.

- Ongoing Maintenance and Optimization: A chargeback model is not a one-time implementation. It requires ongoing maintenance and optimization to ensure its accuracy, fairness, and effectiveness. This includes regularly reviewing chargeback rates, monitoring resource usage, and making adjustments as needed.

Impact of Chargeback on Cost Transparency and Resource Allocation

IT chargeback models have a profound impact on cost transparency and resource allocation, fostering a more efficient and accountable cloud environment.

- Enhanced Cost Transparency: The implementation of a chargeback model drastically improves cost transparency by providing detailed insights into cloud spending across departments, projects, and services. This allows organizations to identify areas of high expenditure and understand the drivers behind them. For instance, a retail company using cloud services for its e-commerce platform can pinpoint the specific cloud resources consumed by each product category during peak shopping seasons.

This level of detail enables better decision-making regarding resource allocation and cost optimization.

- Improved Resource Allocation: Chargeback models facilitate more effective resource allocation by linking cloud usage directly to departments or projects. This connection enables organizations to optimize resource utilization by identifying underutilized resources and reallocating them to areas with higher demand. For example, if a specific development team consistently over-provisions its cloud resources, the chargeback model will highlight this inefficiency, prompting the team to scale down its resources and reduce costs.

This dynamic allocation ensures that resources are used efficiently and aligned with business needs.

- Data-Driven Decision Making: Chargeback data provides valuable insights for data-driven decision-making. By analyzing chargeback reports, organizations can identify trends in cloud spending, predict future costs, and make informed decisions about resource allocation and investment. For example, a software company can use chargeback data to analyze the cost-effectiveness of different cloud services and make decisions about which services to use for future projects.

- Increased Accountability and Ownership: Chargeback models promote accountability and ownership of cloud costs. By assigning costs to specific departments or projects, these models encourage teams to take responsibility for their cloud spending and make more cost-conscious decisions. This can lead to a shift in behavior, with teams actively seeking ways to optimize their resource usage and reduce costs.

- Budgeting and Forecasting Improvements: The detailed cost data provided by chargeback models improves budgeting and forecasting accuracy. Organizations can use historical chargeback data to predict future cloud costs and allocate budgets more effectively. For instance, a financial services company can use chargeback data to forecast its cloud spending for the upcoming year, taking into account factors such as seasonal fluctuations in demand and the introduction of new services.

Selecting a Chargeback Methodology

Choosing the right chargeback methodology is crucial for accurately allocating cloud costs and promoting responsible cloud resource consumption. The selection process depends on factors such as the organization’s size, cloud service complexity, and financial goals. A well-defined methodology ensures fairness, transparency, and alignment between IT spending and business unit needs.

Chargeback Methodologies for Cloud Costs

Several chargeback methodologies can be applied to cloud costs, each with its own advantages and disadvantages. The best choice depends on the specific requirements and objectives of the organization. Understanding these methodologies is essential for making an informed decision.

- Cost-Plus: This methodology involves calculating the actual cost of the cloud resources used and adding a markup to cover internal IT overhead, such as management and support costs.

- Markup: Similar to cost-plus, the markup methodology applies a percentage markup to the actual cloud costs. This markup is typically higher than in cost-plus to account for a wider range of internal IT expenses.

- Hybrid: This approach combines elements of different methodologies. For example, it might use cost-plus for some services and a fixed price or markup for others, offering flexibility.

- Showback: This method informs business units about their cloud spending without directly charging them. It provides transparency and encourages cost awareness.

- Allocation Based on Consumption: This is a fundamental method, allocating costs based on actual resource consumption (e.g., CPU hours, storage GBs).

Comparison of Chargeback Methodologies

The following table provides a comparison of the pros and cons of each methodology. This comparison helps organizations evaluate the suitability of each approach based on their specific needs.

| Methodology | Pros | Cons | Example Application |

|---|---|---|---|

| Cost-Plus |

|

| Compute: Charge a business unit the cost of EC2 instances used, plus a 10% markup for IT support. |

| Markup |

|

| Storage: Charge a business unit $0.03 per GB of storage used, representing the cloud provider cost plus a markup. |

| Hybrid |

|

| Networking: Use cost-plus for bandwidth charges and a fixed monthly fee for VPN connections. |

| Showback |

|

| All Services: Provide business units with detailed reports showing their cloud spending, broken down by service and resource type, without any charges. |

| Allocation Based on Consumption |

|

| Compute: Charge per CPU hour used. Storage: Charge per GB of storage used per month. Networking: Charge per GB of data transferred. |

Applying Methodologies to Cloud Services

Different cloud services can be charged using various methodologies. The choice of methodology often depends on the nature of the service and the organization’s cost management goals.

- Compute:

- Cost-Plus: Charge the cost of EC2 instances plus a markup for IT support.

- Markup: Charge a fixed price per vCPU-hour, covering the cloud provider’s cost and an internal markup.

- Allocation Based on Consumption: Charge per CPU hour or per instance type and size.

- Storage:

- Markup: Charge a fixed price per GB of storage used per month.

- Cost-Plus: Charge the cost of S3 storage plus a markup.

- Allocation Based on Consumption: Charge per GB of storage used, with different rates for different storage tiers.

- Networking:

- Hybrid: Use cost-plus for bandwidth charges and a fixed monthly fee for VPN connections.

- Markup: Charge a fixed rate per GB of data transferred.

- Allocation Based on Consumption: Charge per GB of data transferred or per IP address used.

Cloud Cost Allocation Strategies

Effective cloud cost allocation is crucial for accurately tracking and managing cloud spending. This allows organizations to understand where their money is going, identify areas for optimization, and hold business units accountable for their cloud consumption. Several strategies can be employed to allocate these costs fairly and transparently.

Common Cloud Cost Allocation Strategies

Several approaches can be used to allocate cloud costs. Selecting the right strategy depends on the organization’s size, structure, and the complexity of its cloud environment.

- Resource Consumption-Based Allocation: Costs are allocated based on the actual resources consumed by each business unit or department. This is often considered the most accurate method.

- Tag-Based Allocation: Cloud resources are tagged with metadata (e.g., department, project, application) to track and allocate costs.

- Showback Allocation: Departments are informed of their cloud spending without directly charging them. This can be a stepping stone to full chargeback.

- Hybrid Allocation: A combination of different allocation methods is used, tailored to specific needs or resource types.

- Fixed Budget Allocation: Each business unit receives a fixed budget for cloud services, and costs are allocated based on that budget.

Allocating Costs Based on Resource Consumption

Allocating costs based on resource consumption provides the most granular and accurate view of cloud spending. This method directly ties costs to the actual resources used. This typically involves tracking and measuring various resource metrics.

- CPU Hours: Compute costs are allocated based on the number of CPU hours consumed by each business unit’s virtual machines or instances. For example, if Business Unit A used 100 CPU hours and Business Unit B used 200 CPU hours, and the total CPU cost was $300, Business Unit A would be charged $100, and Business Unit B would be charged $200.

- Memory Usage: Memory costs are allocated based on the amount of memory used. This is especially important for applications that are memory-intensive.

- Storage Usage: Costs are allocated based on the amount of storage used (e.g., GB-month). This includes object storage, block storage, and file storage. For example, if the cost per GB-month is $0.10 and Business Unit C used 500 GB of storage, the allocation would be $50.

- Data Transfer: Data transfer costs (inbound and outbound) are allocated based on the amount of data transferred in and out of the cloud. This is critical for applications with high network traffic.

- Network Bandwidth: Costs can be allocated based on the amount of network bandwidth used. This is similar to data transfer but can be more specific to network infrastructure.

- API Requests: For services like API gateways or database services, costs can be allocated based on the number of API requests made.

- Database Transactions: For database services, costs can be allocated based on the number of database transactions performed.

- Licensing: The cost of software licenses (e.g., operating systems, databases) can be allocated based on usage or the number of instances running the software.

Dealing with Shared Cloud Resources

Shared cloud resources, such as load balancers, shared databases, or network infrastructure, present a challenge in cost allocation. Fairly distributing the costs of these resources requires careful consideration.

- Weighted Allocation: Costs are allocated based on a weighted average of resource usage. For example, if a load balancer serves traffic for multiple business units, the costs can be allocated based on the percentage of traffic each unit generates.

- Proportional Allocation: Costs are distributed proportionally based on the resources used by each business unit. For example, if a shared database’s storage is used by two business units, the costs are divided proportionally based on the storage each unit consumes.

- Usage-Based Allocation: Costs are allocated based on the actual usage of the shared resource. This could involve tracking metrics like the number of requests, data transferred, or processing time.

- Cost-Sharing Agreements: Formal agreements between business units can define how shared resource costs are split. This is especially useful when the usage patterns are complex or uneven.

- Resource Tagging: Utilizing tags on shared resources allows for better tracking and allocation. Even if the resource is shared, tags can help identify which business units are utilizing it.

- Monitoring and Analysis: Implementing robust monitoring and analysis tools is essential to understand the usage patterns of shared resources. This allows for data-driven allocation decisions.

- Example: Shared Database: Consider a shared database instance. If Business Unit X uses 60% of the database storage and Business Unit Y uses 40%, the database costs (e.g., storage, compute) are allocated proportionally:

Business Unit X cost = 0.60

– Total Database Cost

Business Unit Y cost = 0.40

– Total Database Cost

Choosing the Right Tools and Technologies

Selecting the appropriate tools and technologies is crucial for successfully implementing an IT chargeback model for cloud costs. These tools automate cost allocation, provide visibility into cloud spending, and streamline the integration with existing financial systems. This section explores specific cloud cost management tools and their capabilities, along with examples of integration and essential platform features.

Cloud Cost Management Tools and Their Capabilities

Several cloud cost management tools are available, each offering unique features and functionalities to support chargeback implementation. These tools often integrate with major cloud providers and offer comprehensive reporting and analysis capabilities.

- CloudHealth by VMware: This platform provides robust cost optimization, governance, and automation features. CloudHealth allows users to analyze cloud spending across multiple cloud providers, identify cost-saving opportunities, and implement chargeback models based on various criteria such as resource usage, department, or project. For example, CloudHealth can generate detailed reports showing the cost of each virtual machine, storage volume, and network connection, and allocate those costs to the appropriate business units.

It can also automate the process of tagging resources and applying chargeback rates.

- AWS Cost Explorer and AWS Cost & Usage Report (CUR): Amazon Web Services (AWS) offers built-in tools for cost management. AWS Cost Explorer allows users to visualize and analyze their AWS costs over time. The AWS Cost & Usage Report (CUR) provides detailed information about AWS usage and costs, which can be used to create custom chargeback reports. Users can leverage these tools to define cost allocation tags, track spending by department or project, and generate chargeback invoices.

For instance, a company can use CUR data to calculate the cost of each EC2 instance used by a specific team and then charge that team accordingly.

- Microsoft Azure Cost Management + Billing: Microsoft Azure provides native cost management tools that enable users to track and analyze Azure spending. Azure Cost Management + Billing allows users to monitor costs, set budgets, and implement chargeback models. This platform supports cost allocation through the use of resource tags and allows users to create custom reports and dashboards. A company might use this tool to track the cost of Azure resources consumed by a specific application and charge the application’s owner.

- Google Cloud Cost Management: Google Cloud Platform (GCP) offers tools like Cloud Billing for cost management and chargeback. Cloud Billing provides detailed cost data, enabling users to analyze spending, identify cost optimization opportunities, and implement chargeback models. Users can utilize labels to categorize resources and allocate costs to different departments or projects. For example, a company can use Google Cloud’s cost management tools to track the cost of data storage and processing services used by different teams and then implement chargeback based on usage.

- Third-Party Cost Management Platforms: Several third-party tools offer advanced features for cloud cost management and chargeback. These platforms often provide integrations with multiple cloud providers and offer advanced analytics and automation capabilities. Examples include tools like CloudCheckr, Densify, and Apptio. These tools can provide a centralized view of cloud spending across multiple clouds and enable advanced cost optimization strategies, such as identifying idle resources or right-sizing instances.

Integrating Chargeback Systems with Financial and Accounting Systems

Integrating chargeback systems with existing financial and accounting systems is crucial for accurate billing and reconciliation. This integration ensures that cloud costs are accurately reflected in the company’s financial statements.

- Integration Methods: Integration can be achieved through various methods, including direct API connections, data exports, and the use of middleware. Most cloud cost management tools offer APIs that allow for the automated export of cost data. This data can then be imported into financial systems for billing and reporting purposes.

- Examples of Integration:

- API Integration: A company can use the APIs of a cloud cost management tool to automatically export cost data to its accounting system. For instance, they can create a script that pulls the cost data for each department and automatically generates invoices in their accounting software, such as NetSuite or SAP.

- Data Export and Import: Another method involves exporting cost data from the cloud cost management tool in a CSV or Excel format and importing it into the financial system. This approach is suitable for smaller organizations or those with less complex requirements.

- Middleware: Middleware solutions, such as data integration platforms, can be used to connect the cloud cost management tool with the financial system. These platforms can transform the data, handle complex mappings, and automate the integration process.

- Key Considerations: When integrating chargeback systems, it’s important to consider the following:

- Data Mapping: Ensure that the data fields in the cloud cost management tool align with the corresponding fields in the financial system.

- Automation: Automate the data transfer process to minimize manual effort and reduce the risk of errors.

- Security: Secure the data transfer process to protect sensitive financial information.

- Reporting: Generate reports that provide visibility into cloud spending and chargeback accuracy.

Essential Features of a Cloud Cost Management Platform

A robust cloud cost management platform should offer several essential features to support effective chargeback implementation. These features enable organizations to gain visibility into their cloud spending, optimize costs, and implement fair and accurate chargeback models.

Essential Features:

- Cost Visibility: Detailed dashboards and reports showing cloud spending across different dimensions, such as resources, departments, and projects.

- Cost Allocation: The ability to allocate cloud costs to different business units based on various criteria, such as resource usage, tags, or custom rules.

- Cost Optimization: Tools for identifying and implementing cost-saving opportunities, such as right-sizing instances, eliminating idle resources, and leveraging reserved instances.

- Budgeting and Forecasting: Capabilities for setting budgets, monitoring spending against those budgets, and forecasting future cloud costs.

- Reporting and Analytics: Customizable reports and dashboards that provide insights into cloud spending and chargeback performance.

- Automation: Automated processes for cost allocation, reporting, and invoice generation.

- Integration: Integration with existing financial and accounting systems.

- Alerting: Real-time alerts for cost overruns, anomalies, and other important events.

Setting Up Chargeback Policies and Procedures

Establishing clear chargeback policies and procedures is critical for the successful implementation and ongoing management of an IT chargeback model. These policies provide the framework for how cloud costs are allocated, billed, and managed across the organization. Without them, the chargeback process can become chaotic, leading to confusion, disputes, and ultimately, a lack of trust in the system. A well-defined policy ensures transparency, accountability, and fairness in the distribution of cloud expenses.

Importance of Clear Chargeback Policies and Procedures

Clear policies and procedures are the foundation of a successful IT chargeback model. They define the rules of engagement, ensuring everyone understands their responsibilities and how cloud resources are charged.

- Transparency and Accountability: Well-defined policies make the chargeback process transparent, showing exactly how costs are calculated and allocated. This fosters accountability, as users and departments understand their cloud spending and can take ownership of their resource consumption.

- Fairness and Consistency: Consistent application of policies ensures fairness across all users and departments. Standardized rates, billing cycles, and allocation methods prevent arbitrary charges and ensure that everyone is treated equally.

- Reduced Disputes: Clear policies reduce the likelihood of disputes. When the rules are clearly defined, there’s less room for misunderstanding or disagreement about charges. This saves time and resources that would otherwise be spent resolving conflicts.

- Improved Budgeting and Forecasting: With predictable chargeback costs, departments can better budget and forecast their cloud spending. This enables more accurate financial planning and resource allocation.

- Enhanced Cost Control: Understanding cloud costs and the impact of resource consumption empowers users and departments to control their spending. Clear policies encourage responsible resource usage and can lead to significant cost savings.

- Compliance and Governance: Chargeback policies can be aligned with compliance requirements and internal governance procedures. This helps ensure that cloud usage adheres to organizational policies and industry regulations.

Steps Involved in Establishing Chargeback Policies

Establishing chargeback policies involves several key steps, from defining rates to setting up dispute resolution processes. This structured approach ensures the policies are comprehensive and address all critical aspects of cloud cost management.

- Define Cloud Services and Resources: Identify all cloud services and resources to be included in the chargeback model. This includes compute instances, storage, networking, databases, and any other relevant services.

- Establish Cost Allocation Methods: Determine how costs will be allocated. This may involve direct allocation (charging based on actual usage), indirect allocation (using factors like department size), or a hybrid approach.

- Define Pricing Rates: Set the pricing rates for each cloud service and resource. These rates can be based on various factors, such as the cloud provider’s pricing, internal cost calculations, or a combination of both. Consider offering tiered pricing or discounts for large-scale usage. For example, a compute instance could be priced at $0.05 per hour for the first 100 hours, then $0.04 per hour for usage exceeding 100 hours.

- Determine Billing Cycles: Decide on the billing cycle frequency (e.g., monthly, quarterly). Consider the needs of the organization and the cloud provider’s billing practices. Monthly billing is a common practice for cloud cost management, providing regular visibility into spending.

- Develop a Billing Process: Artikel the billing process, including how invoices are generated, delivered, and paid. This should include details on payment methods and due dates.

- Implement a Dispute Resolution Process: Establish a clear process for resolving disputes related to chargeback invoices. This process should include steps for submitting disputes, reviewing the charges, and reaching a resolution. A formal process ensures that disputes are handled fairly and efficiently. For instance, the process might involve the user submitting a dispute within 15 days of receiving the invoice, followed by an investigation by the IT department, and a final resolution.

- Document the Policies and Procedures: Create a comprehensive document outlining all chargeback policies and procedures. This document should be easily accessible to all stakeholders and regularly updated.

- Communicate and Train: Communicate the chargeback policies and procedures to all relevant stakeholders, including users, departments, and IT staff. Provide training to ensure everyone understands the policies and how they impact their cloud usage.

- Monitor and Review: Continuously monitor the chargeback model and review the policies and procedures regularly. Make adjustments as needed to reflect changes in cloud usage, pricing, or organizational needs. This could involve quarterly reviews of pricing rates or annual updates to allocation methodologies.

Template for a Chargeback Policy Document

A chargeback policy document should be a comprehensive resource that clearly communicates the rules and procedures for cloud cost allocation. The following is a suggested template, which can be adapted to fit the specific needs of an organization.

Chargeback Policy Document

1. Introduction

1.1 Purpose of the Chargeback Policy

1.2 Scope of the Policy (which cloud services are included)

1.3 Policy Owner and Contact Information

2. Cloud Services and Resources Covered

2.1 List of Cloud Services (e.g., Compute, Storage, Networking, Databases)

2.2 Details on Resource Units (e.g., vCPU hours, GB of storage, data transfer)

3. Cost Allocation Methodology

3.1 Allocation Method (e.g., Direct, Indirect, Hybrid)

3.2 Allocation Rules (how costs are assigned to departments or users)

3.3 Examples of Cost Allocation (Illustrative examples of how costs are calculated)

4. Pricing and Rates

4.1 Pricing Model (e.g., Fixed, Variable, Tiered)

4.2 Rate Card (detailed list of rates for each service and resource)

4.3 Rate Review and Adjustment Process (how rates are reviewed and updated)

5. Billing and Invoicing

5.1 Billing Cycle Frequency (e.g., Monthly)

5.2 Invoice Generation Process

5.3 Invoice Delivery Method (e.g., Email, Portal)

5.4 Payment Terms and Due Dates

6. Dispute Resolution

6.1 Dispute Submission Process (how to submit a dispute)

6.2 Dispute Review Process (steps for investigating disputes)

6.3 Escalation Process (if the dispute cannot be resolved)

7. Policy Updates and Revisions

7.1 Policy Review Frequency

7.2 Change Management Process (how policy changes are communicated)

8. Appendices

8.1 Definitions of Terms

8.2 Contact Information for Support

This template provides a comprehensive framework. The specific content within each section will vary based on the organization’s specific cloud environment, cost allocation strategies, and billing practices. The key is to be clear, concise, and provide all necessary information to ensure a smooth and transparent chargeback process.

Implementing Chargeback in Different Cloud Environments

Implementing an IT chargeback model requires careful consideration of the specific cloud environment in use. Each major cloud provider—AWS, Azure, and GCP—presents unique characteristics and tools that influence how chargeback is implemented. Adapting the chargeback model to these differences ensures accurate cost allocation and effective cost management across the organization.

Chargeback in AWS

AWS offers a comprehensive suite of services and tools for implementing chargeback. These resources facilitate detailed cost tracking and allocation, enabling organizations to accurately attribute cloud expenses to specific departments or projects.

- AWS Cost Explorer: This tool provides a visual interface for analyzing and understanding AWS costs. Users can filter and group costs by various dimensions, such as service, resource type, tags, and accounts, which is crucial for identifying cost drivers and allocating costs.

- AWS Cost and Usage Reports (CUR): CUR provides detailed, granular data about AWS costs and usage. This data can be exported to an S3 bucket and used to build custom chargeback reports and dashboards. The data includes information about resource-level usage, which is essential for accurate chargeback calculations.

- AWS Organizations: AWS Organizations enables the creation of multiple accounts within a single organization, allowing for the logical separation of resources and costs. This is beneficial for allocating costs to different departments or business units.

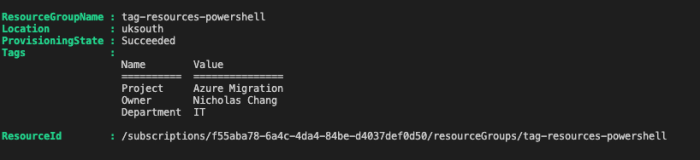

- Tagging: AWS supports tagging resources with metadata, allowing for the grouping and allocation of costs based on business units, projects, or other relevant criteria. Consistent tagging is critical for the accuracy of chargeback.

Chargeback in Azure

Azure’s chargeback implementation relies on a similar set of tools and functionalities, designed to provide visibility into cloud spending and enable accurate cost allocation.

- Azure Cost Management + Billing: This service offers robust capabilities for analyzing and managing Azure costs. It provides features such as cost analysis, budgeting, and anomaly detection. Users can filter and group costs by resource groups, tags, and other dimensions to understand cost drivers.

- Cost Management APIs: Azure provides APIs that allow for programmatic access to cost data, enabling the creation of custom chargeback solutions and integrations with existing financial systems.

- Azure Resource Manager (ARM) Templates: ARM templates can be used to deploy and manage Azure resources. By tagging resources during deployment, organizations can easily track and allocate costs.

- Management Groups: Management groups allow for the organization of subscriptions into a hierarchical structure, which can be used to manage costs and apply policies across multiple subscriptions.

Chargeback in Google Cloud Platform (GCP)

GCP provides tools and services that facilitate chargeback implementation, similar to AWS and Azure. These resources enable detailed cost tracking and allocation, promoting financial accountability and cost optimization.

- Cloud Billing: GCP’s Cloud Billing service offers features for cost analysis, budgeting, and export of cost data. Users can filter and group costs by various dimensions, such as project, labels, and services.

- Cloud Billing Reports: GCP provides pre-built reports and dashboards that visualize cost data, making it easier to understand spending patterns and identify cost drivers.

- Cloud Billing Export: Cost data can be exported to BigQuery for further analysis and customization. This allows organizations to build custom chargeback reports and integrate cost data with other business intelligence tools.

- Labels: GCP supports the use of labels to tag resources with metadata, enabling the grouping and allocation of costs based on business units, projects, or other relevant criteria.

Adapting Chargeback to Cloud Service Models

The implementation of chargeback varies depending on the cloud service model—IaaS, PaaS, or SaaS—utilized. Each model presents different cost allocation considerations.

- IaaS (Infrastructure as a Service): With IaaS, chargeback models typically focus on resource consumption metrics such as compute hours, storage capacity, network bandwidth, and data transfer. The cost allocation is often based on the actual usage of these resources by different departments or projects.

- PaaS (Platform as a Service): In PaaS environments, chargeback models must consider the consumption of platform services such as database instances, application runtimes, and API calls. The cost allocation is often based on service-specific metrics, such as the number of transactions, storage used, or the amount of data processed.

- SaaS (Software as a Service): Chargeback in SaaS environments can be more straightforward, as the pricing is typically based on user licenses, features used, or the volume of data processed. The cost allocation is often based on the number of users, the features used by each department, or the amount of data stored and processed.

Best Practices for Multi-Cloud Chargeback

Implementing chargeback in a multi-cloud environment presents additional complexities. Effective multi-cloud chargeback requires a unified approach to cost tracking, allocation, and reporting.

- Centralized Cost Data Aggregation: Aggregate cost data from all cloud providers into a single platform. This provides a consolidated view of cloud spending and simplifies cost allocation. Tools like CloudHealth by VMware or CloudCheckr can assist in this process.

- Standardized Tagging Strategy: Implement a consistent tagging strategy across all cloud providers. This ensures that resources are properly tagged and that costs can be accurately allocated to the appropriate departments or projects.

- Automated Cost Allocation Rules: Develop automated rules for allocating costs based on resource usage, tags, and other relevant criteria. This reduces manual effort and ensures consistent cost allocation across all cloud providers.

- Custom Reporting and Dashboards: Create custom reports and dashboards that provide a unified view of cloud spending across all providers. These reports should include key metrics such as cost per department, cost per project, and cost trends.

- Use of Third-Party Cost Management Tools: Consider using third-party cost management tools that support multi-cloud environments. These tools provide advanced features for cost analysis, optimization, and reporting.

Data Collection and Reporting for Chargeback

Accurate data collection and insightful reporting are crucial for a successful IT chargeback model. Without reliable data, the entire process becomes ineffective, leading to inaccurate cost allocations and potential disputes. This section details the types of data needed, how to collect it, and how to present it effectively.

Types of Data Needed

To accurately track and report cloud costs for chargeback, several categories of data are essential. This data must be comprehensive, granular, and readily available for analysis.

- Cost and Usage Data: This is the foundation of the chargeback process. It includes detailed information about resource consumption.

- Resource Type: Identifies the specific cloud resources used (e.g., virtual machines, storage, databases, network bandwidth).

- Usage Metrics: Quantifies resource consumption (e.g., CPU hours, GB of storage, data transfer in/out).

- Cost Breakdown: Shows the associated cost for each resource and usage metric.

- Pricing Model: Specifies the pricing model applied (e.g., on-demand, reserved instances, spot instances).

- Metadata: Provides context to the cost and usage data, enabling accurate allocation.

- Tags: Key-value pairs applied to cloud resources, allowing for categorization by department, project, application, or environment.

- Account Information: Identifies the cloud account or subscription where the resources are deployed.

- Resource IDs: Unique identifiers for each resource, allowing for tracking and auditing.

- Allocation Rules: Defines how costs are distributed to different consumers.

- Chargeback Policies: Documents the rules and formulas used to calculate charges.

- Mapping Definitions: Links resources and usage data to specific cost centers or departments.

- Performance Data: While not directly used for chargeback, performance data can provide valuable insights.

- Resource Utilization: Monitors the efficiency of resource usage.

- Application Performance: Tracks application response times and other key performance indicators (KPIs).

Collecting and Processing Data from Cloud Providers

Collecting and processing data from cloud providers involves several steps to ensure accuracy and completeness. Different cloud providers offer various methods for accessing cost and usage information.

- Accessing Cloud Provider Data: Cloud providers offer APIs, dashboards, and reporting tools to access cost and usage data.

- Cloud Provider APIs: These APIs allow programmatic access to cost and usage data. Popular examples include AWS Cost Explorer API, Azure Cost Management API, and Google Cloud Billing API. These APIs can be integrated with chargeback tools to automate data collection.

- Cloud Provider Dashboards: These dashboards provide a visual representation of cost and usage data. While useful for quick analysis, they often lack the granularity needed for detailed chargeback.

- Cloud Provider Reporting Tools: Many providers offer reporting tools that can generate custom reports. These reports can be downloaded in various formats (e.g., CSV, JSON) for further processing.

- Data Extraction and Transformation: The collected data often requires transformation to be usable for chargeback.

- Data Extraction: The process of retrieving data from cloud provider APIs or reports.

- Data Transformation: Cleaning, formatting, and structuring the data to align with the chargeback model. This includes mapping tags, aggregating data, and applying allocation rules.

- Data Loading: Importing the transformed data into a chargeback tool or data warehouse.

- Data Aggregation and Storage: Aggregating and storing data is essential for analysis and reporting.

- Data Aggregation: Summarizing data based on various criteria (e.g., department, project, resource type).

- Data Storage: Storing the aggregated data in a data warehouse or database for long-term analysis.

- Automation: Automating the data collection and processing pipeline is crucial for efficiency.

- Scripting: Using scripts (e.g., Python, Bash) to automate data extraction, transformation, and loading.

- Workflow Tools: Utilizing workflow tools to orchestrate the data pipeline.

Sample Report: Cloud Cost Visualization for Chargeback

A well-designed report provides a clear and concise view of cloud costs, enabling stakeholders to understand their spending and identify areas for optimization. The report should be easily customizable and provide a level of detail suitable for the intended audience.

The following is a sample report demonstrating how to visualize cloud cost data for chargeback. This report is designed to be easily understood by non-technical stakeholders and provides key insights into cloud spending.

| Department | Month | Cost Center | Total Cost | VM Cost | Storage Cost | Network Cost | Database Cost | Other Costs |

|---|---|---|---|---|---|---|---|---|

| Marketing | January | Marketing-Campaign-A | $5,000 | $2,000 | $1,000 | $500 | $1,000 | $500 |

| Marketing | January | Marketing-Campaign-B | $3,000 | $1,000 | $500 | $300 | $1,000 | $200 |

| Engineering | January | Engineering-Project-X | $10,000 | $5,000 | $2,000 | $1,000 | $1,000 | $1,000 |

| Engineering | January | Engineering-Project-Y | $7,000 | $3,000 | $1,500 | $800 | $1,200 | $500 |

| Sales | January | Sales-Region-1 | $4,000 | $1,500 | $1,000 | $400 | $800 | $300 |

Report Description: This sample report provides a monthly cost breakdown for each department and cost center. It includes the total cost, as well as a breakdown of costs by resource type (VM, storage, network, database, and other costs). The data is presented in a tabular format for easy readability. Additional visualizations, such as charts and graphs, could be added to the report for further analysis.

For example, a pie chart could be used to visualize the percentage of total cost spent by each department. A line graph could show the trend of spending over time for each department. Such visualizations can help to identify trends and anomalies in spending patterns, enabling stakeholders to make informed decisions.

Note: This is a simplified example. In a real-world scenario, reports would be more detailed and customizable, often including filtering and drill-down capabilities. The level of detail depends on the specific needs of the organization and the complexity of its cloud environment.

Communication and Stakeholder Engagement

Implementing an IT chargeback model is a significant undertaking that requires a well-defined communication strategy to ensure its success. Effective communication and stakeholder engagement are crucial for gaining buy-in, managing expectations, and ensuring the smooth adoption of the new system. Without a proactive approach to communication, the chargeback model can be met with resistance, confusion, and ultimately, failure.

Importance of Effective Communication

Clear and consistent communication is the cornerstone of a successful chargeback implementation. It helps to build trust, manage expectations, and minimize resistance from stakeholders.Effective communication facilitates several key benefits:

- Transparency: It provides clear visibility into cloud costs and how they are allocated. This transparency fosters trust and reduces the likelihood of misunderstandings.

- Understanding: It ensures that all stakeholders understand the purpose, methodology, and impact of the chargeback model. This shared understanding is essential for gaining buy-in.

- Collaboration: It promotes collaboration between IT, finance, and business units. This collaboration is crucial for refining the model and addressing any issues that arise.

- Acceptance: It helps stakeholders accept the chargeback model as a fair and equitable way to allocate cloud costs.

Strategies for Engaging Stakeholders and Gaining Buy-In

Gaining stakeholder buy-in is paramount for the successful implementation of an IT chargeback model. This requires a proactive and multifaceted approach.Key strategies include:

- Identify Stakeholders: Determine all relevant stakeholders, including IT, finance, business unit leaders, application owners, and end-users. Understand their roles, concerns, and information needs.

- Tailor Communication: Customize communication materials and channels to address the specific needs of each stakeholder group. For example, technical teams may require detailed information on the allocation methodology, while business leaders may be more interested in the overall cost savings and budget predictability.

- Early and Frequent Communication: Start communicating early in the process and provide regular updates. This helps to keep stakeholders informed and involved throughout the implementation.

- Address Concerns Proactively: Anticipate potential concerns and address them proactively. For example, if stakeholders are worried about the impact on their budgets, provide examples of how the chargeback model can help them optimize their cloud spending.

- Seek Feedback and Iterate: Actively solicit feedback from stakeholders and use it to refine the chargeback model and communication materials. This demonstrates that their input is valued and helps to build trust.

- Provide Training and Support: Offer training and support to help stakeholders understand how to use the chargeback system and interpret the reports.

Examples of Communication Materials for Educating Stakeholders

A variety of communication materials can be used to educate stakeholders about the chargeback model. The choice of materials should be tailored to the target audience and the stage of the implementation process.Examples include:

- Presentations: Use presentations to introduce the chargeback model, explain the benefits, and address key concerns. Visual aids, such as charts and graphs, can be helpful for illustrating complex concepts.

For example, a presentation might include a slide comparing the current cost allocation method with the proposed chargeback model, highlighting the potential for cost savings and improved budget predictability.

- FAQs (Frequently Asked Questions): Develop a comprehensive FAQ document to address common questions and concerns. This document can be shared widely and updated as needed.

An FAQ might address questions such as, “How will my department be charged for cloud resources?” or “What happens if my budget is exceeded?”

- Webinars and Training Sessions: Host webinars and training sessions to provide in-depth information about the chargeback model and demonstrate how to use the system. These sessions can be recorded and made available on-demand.

A training session might include a hands-on demonstration of how to generate reports and analyze cloud spending.

- Newsletters and Email Updates: Send regular newsletters and email updates to keep stakeholders informed about the progress of the implementation, new features, and any changes to the model.

A newsletter might include a summary of recent cloud spending trends and tips for optimizing cloud costs.

- Dashboards and Reports: Provide access to dashboards and reports that allow stakeholders to track their cloud spending and understand how their costs are allocated.

A dashboard might display a breakdown of cloud costs by department, application, or resource type.

- Informational Brochures and Handouts: Create concise brochures and handouts that summarize the key aspects of the chargeback model. These materials can be distributed at meetings and events.

A brochure might provide a high-level overview of the chargeback process and the benefits for stakeholders.

Optimizing and Refining the Chargeback Model

The implementation of an IT chargeback model is not a one-time event but an ongoing process that requires continuous monitoring, evaluation, and refinement. This iterative approach ensures the model remains accurate, fair, and aligned with the evolving needs of the organization and the dynamic nature of cloud computing. Regular optimization is crucial for maintaining the model’s effectiveness, maximizing cost efficiency, and fostering a positive relationship between IT and business units.

Continuous Improvement Process for an IT Chargeback Model

A continuous improvement process for IT chargeback involves a cyclical approach of planning, doing, checking, and acting (PDCA). This framework provides a structured way to identify areas for improvement, implement changes, and assess their impact. The goal is to progressively enhance the model’s accuracy, transparency, and effectiveness.

- Planning: This initial phase involves defining the objectives of the improvement cycle. It includes identifying specific areas for improvement, such as chargeback accuracy, allocation methods, or reporting capabilities. Data collection and analysis of current performance, using metrics like cost variance, user satisfaction, and report accuracy, helps to pinpoint weaknesses and opportunities. Based on these insights, specific goals are set for the improvement cycle.

For instance, a goal might be to reduce cost variance by 10% or improve the accuracy of resource allocation by implementing a more granular allocation strategy.

- Doing: This phase involves implementing the planned changes. This might include modifying chargeback rates, adjusting allocation methodologies, or updating reporting templates. It’s essential to communicate these changes clearly to stakeholders before implementation. The changes are implemented on a pilot basis or in a controlled environment before full deployment to minimize risks. For example, a pilot program might involve testing a new allocation method with a small group of users before applying it organization-wide.

- Checking: The “checking” phase involves monitoring and evaluating the impact of the implemented changes. This includes collecting data on the performance of the chargeback model after the changes have been made. Key metrics are tracked, such as cost variances, user satisfaction, and report accuracy, to assess whether the changes achieved the desired outcomes. Data analysis is used to compare the results with the initial objectives and identify any unintended consequences.

- Acting: Based on the evaluation, the “acting” phase involves taking corrective actions or making further adjustments. If the changes were successful, they are fully implemented, and the model is updated accordingly. If the changes did not meet the objectives, the reasons are investigated, and further adjustments are made. This might involve reverting to the previous approach, modifying the changes, or trying a new approach.

The cycle then repeats, with the lessons learned from the previous cycle informing the planning phase of the next improvement cycle.

Regular Review and Refinement of Chargeback Rates and Policies

Regular review and refinement of chargeback rates and policies are essential to ensure the IT chargeback model remains fair, accurate, and relevant. This process involves periodically evaluating the model’s performance, considering changes in cloud costs and usage patterns, and making adjustments as needed. A structured approach to this review process ensures that the model adapts to the evolving needs of the organization and cloud environment.

- Frequency of Review: The frequency of reviewing chargeback rates and policies depends on the organization’s size, the complexity of its cloud environment, and the rate of change in cloud costs and usage. Generally, chargeback rates and policies should be reviewed at least quarterly or semi-annually. More frequent reviews may be necessary for rapidly evolving cloud environments or organizations experiencing significant changes in their cloud usage patterns.

- Data Collection and Analysis: A thorough review requires comprehensive data collection and analysis. This includes gathering data on cloud costs, resource usage, and the effectiveness of the current chargeback rates and policies. Data sources include cloud provider invoices, resource utilization reports, and feedback from IT and business units. Analysis should identify trends in cloud costs, usage patterns, and any discrepancies between charged costs and actual costs.

This analysis should also assess the impact of chargeback policies on user behavior and IT spending.

- Rate Adjustment Methods: There are several methods for adjusting chargeback rates:

- Cost-Plus Pricing: This method calculates chargeback rates by adding a markup to the actual cost of providing IT services. The markup covers IT’s operational expenses, such as salaries, hardware, and software. This approach ensures that IT recovers its costs and can be easily implemented, but it may not incentivize cost efficiency.

- Market-Based Pricing: This method bases chargeback rates on the market value of IT services. This approach is suitable for organizations that want to compare the cost of their IT services with those of external providers. Market-based pricing can be more complex to implement, as it requires research into market prices for comparable services.

- Hybrid Pricing: This method combines elements of cost-plus and market-based pricing. For instance, an organization might use cost-plus pricing for internal services and market-based pricing for services that can be easily outsourced. Hybrid pricing offers flexibility and allows organizations to balance cost recovery with market competitiveness.

- Policy Adjustments: In addition to adjusting chargeback rates, it may be necessary to make adjustments to chargeback policies. This might include:

- Allocation Methods: Reviewing and refining the methods used to allocate cloud costs. For example, switching from a simple allocation based on the number of virtual machines to a more granular allocation based on CPU usage, memory consumption, or storage utilization.

- Service Catalog: Updating the service catalog to reflect changes in IT service offerings and cloud infrastructure.

- Reporting and Transparency: Enhancing reporting capabilities to provide users with more detailed information on their cloud spending.

- Thresholds and Budgets: Establishing thresholds or budgets for cloud usage to control costs and encourage responsible resource consumption.

- Stakeholder Engagement: Effective communication and collaboration with stakeholders are critical throughout the review and refinement process. IT should engage with business units to understand their needs and gather feedback on the current chargeback model. Stakeholder feedback can provide valuable insights into the model’s effectiveness and identify areas for improvement.

Iterative Process of Chargeback Model Optimization

The following illustration shows the iterative process of chargeback model optimization, emphasizing continuous improvement.

Illustration: Iterative Process of Chargeback Model Optimization

The illustration is a cyclical diagram representing the iterative process of chargeback model optimization. The diagram has four key stages, arranged in a circular flow, demonstrating a continuous improvement cycle.

Stage 1: Data Collection and Analysis: The first stage is at the top of the cycle and involves “Data Collection and Analysis.” A box represents this stage, with a label inside. Arrows emanate from this box, pointing towards the next stage. This stage is responsible for gathering information on cloud costs, resource usage, and user feedback. The analysis should identify cost trends, usage patterns, and the effectiveness of the current chargeback model.

Stage 2: Evaluation and Planning: The second stage, located on the right side of the cycle, is labeled “Evaluation and Planning.” The box contains this label. This stage assesses the findings from data collection and analysis. Based on the evaluation, plans for improvement are formulated. This includes setting specific goals, such as reducing cost variances or improving the accuracy of resource allocation.

Stage 3: Implementation: The third stage, on the bottom of the cycle, is “Implementation.” A box represents this, which involves making the planned changes. This could include adjusting chargeback rates, modifying allocation methods, or updating reporting templates. Changes are often implemented on a pilot basis to minimize risks.

Stage 4: Review and Monitoring: The fourth stage, on the left side of the cycle, is “Review and Monitoring.” This stage involves monitoring and evaluating the impact of the implemented changes. Key metrics are tracked to assess whether the changes achieved the desired outcomes. This includes cost variances, user satisfaction, and report accuracy.

Cycle Completion: The cycle then repeats, with the lessons learned from the review and monitoring stage informing the data collection and analysis stage of the next improvement cycle. This continuous feedback loop ensures that the chargeback model remains aligned with the organization’s needs and the evolving cloud environment.

Final Thoughts

In conclusion, mastering the implementation of an IT chargeback model for cloud costs is a journey that requires careful planning, strategic execution, and continuous refinement. By embracing the principles Artikeld in this guide, organizations can unlock significant benefits, including improved cost transparency, enhanced resource allocation, and a stronger alignment between IT and business objectives. Remember that the most effective chargeback models are those that evolve with your organization’s needs, fostering a culture of financial responsibility and cloud optimization.

Implementing a chargeback model is not just about assigning costs; it’s about empowering your team with insights and control over their cloud consumption.

Popular Questions

What is the difference between chargeback and showback?

Chargeback involves assigning actual cloud costs to specific business units or departments, effectively billing them for their resource consumption. Showback, on the other hand, provides visibility into cloud spending without direct billing, offering insights into resource usage and cost trends.

How do I handle shared resources in a chargeback model?

Shared resources can be allocated based on usage metrics (e.g., storage volume, network traffic) or through a predefined allocation key. The goal is to distribute costs fairly and transparently, ensuring each unit is accountable for its portion of the shared resources.

What are the key benefits of implementing a chargeback model?

Key benefits include increased cost transparency, improved resource allocation, better financial accountability, enhanced IT-business alignment, and the ability to identify and optimize cloud spending inefficiencies.

What are the biggest challenges in implementing a chargeback model?

Challenges often include data collection complexities, stakeholder buy-in, the need for robust cost allocation methodologies, the integration of chargeback systems with existing financial processes, and the ongoing maintenance and refinement of the model.

How often should I review and adjust my chargeback rates?

Chargeback rates should be reviewed and adjusted at least quarterly, or more frequently if cloud costs or resource usage patterns change significantly. Regular reviews ensure the model remains accurate, fair, and aligned with business needs.