TrendEdge

Get better at investing with big data insights and AI stock analysis. Evaluate each company with the help of AI signals that combine social sentiment and technical indicators

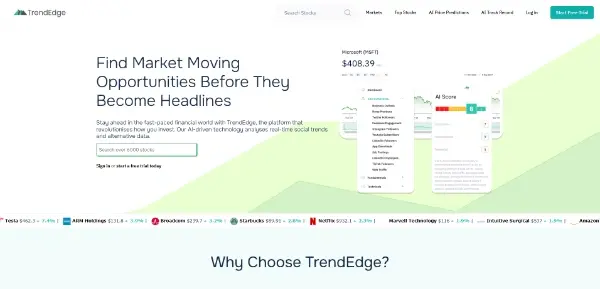

TrendEdge: Leveraging AI for Smarter Investing

TrendEdge is a freemium AI-powered tool designed to enhance investment decision-making by providing insightful analysis based on big data and sophisticated algorithms. It bridges the gap between raw market data and actionable intelligence, empowering investors of all levels to make more informed choices.

What TrendEdge Does

TrendEdge analyzes vast quantities of data, combining traditional technical indicators with the power of social sentiment analysis. This unique approach allows it to generate AI-driven signals that provide a comprehensive evaluation of individual companies. Instead of relying solely on historical price movements, TrendEdge offers a more nuanced perspective, incorporating the collective "wisdom" of the crowd as reflected in online discussions and social media activity. This helps investors identify potential investment opportunities and mitigate risks more effectively.

Main Features and Benefits

AI-Driven Stock Signals: TrendEdge's core function is the generation of clear, concise buy/sell/hold signals based on its proprietary AI algorithms. These signals consider both technical indicators (e.g., moving averages, RSI, MACD) and social sentiment, providing a more holistic view of a company's potential.

Social Sentiment Analysis: The tool taps into a vast network of online sources to gauge public opinion regarding specific companies. Positive sentiment may suggest growing investor confidence, while negative sentiment could be a warning sign.

Technical Indicator Integration: Traditional technical analysis remains a vital component. TrendEdge integrates established indicators, providing investors with familiar data points alongside the AI-generated signals. This allows for a comparative analysis and a deeper understanding of the underlying trends.

Data Visualization: TrendEdge presents its findings in clear, easy-to-understand visualizations, making complex data accessible to both novice and experienced investors. This simplifies the interpretation of signals and facilitates faster decision-making.

Customizable Dashboards: Users can personalize their dashboards to focus on specific stocks or sectors, tailoring their experience to their individual investment strategies.

Benefits:

- Improved Investment Decisions: By combining technical and sentiment analysis, TrendEdge helps investors make more informed and data-driven investment decisions.

- Risk Mitigation: The tool can help identify potential red flags early on, assisting in risk management and portfolio diversification.

- Time Savings: The automated analysis frees up valuable time for investors to focus on other aspects of their investment strategy.

- Enhanced Market Understanding: TrendEdge provides a more comprehensive view of market trends and sentiment, improving overall market awareness.

Use Cases and Applications

TrendEdge caters to a wide range of users and investment styles:

- Individual Investors: Ideal for individuals looking to improve their stock picking skills and make more informed investment choices.

- Day Traders: The real-time data and signals can be particularly beneficial for short-term trading strategies.

- Portfolio Managers: TrendEdge can be used as a supplementary tool to enhance existing portfolio management processes.

- Financial Analysts: It can supplement existing analytical tools by offering unique insights from social sentiment analysis.

Comparison to Similar Tools

TrendEdge differentiates itself from competitors by its unique blend of technical indicators and social sentiment analysis. While many platforms offer either technical analysis or sentiment analysis individually, TrendEdge's combined approach provides a more holistic and potentially more accurate prediction of market movements. Other tools might focus solely on algorithmic trading or require extensive programming knowledge. TrendEdge aims for user-friendliness and accessibility, making advanced AI-driven insights available to a broader audience. A direct comparison to specific competitors requires knowing which tools are being compared.

Pricing Information

TrendEdge operates on a freemium model. A free plan offers limited access to features and data, allowing users to experience the platform's capabilities. Paid subscription plans unlock access to more advanced features, broader data sets, and higher frequency updates. The specific pricing details for paid plans should be checked directly on the TrendEdge website.

Conclusion

TrendEdge offers a promising approach to investment analysis, combining the power of AI with traditional methods. Its freemium model makes its capabilities accessible to a wide audience, potentially empowering investors to make smarter, data-driven decisions in the complex world of financial markets. However, it's crucial to remember that no tool can guarantee investment success, and responsible investment practices remain paramount.