Cotter AI

An AI tool that rates S&P 500 stocks from poor to excellent. The site uses the GPT model to perfect its analysis

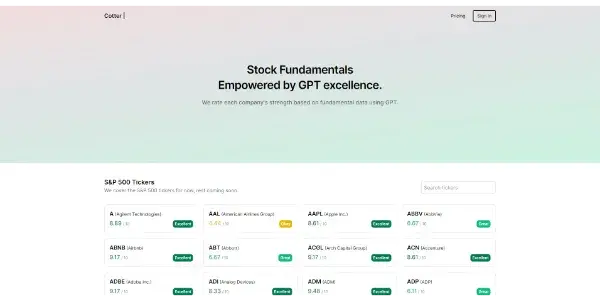

Cotter AI: An AI-Powered Stock Rating Tool

Cotter AI is a freemium AI-powered tool designed to analyze and rate S&P 500 stocks, providing investors with a simplified assessment of investment potential. Leveraging the capabilities of the GPT model (likely a variant or adaptation for financial analysis), Cotter AI offers a unique approach to stock screening and evaluation. While categorized under "RIP AI" (suggesting a focus on rapidly identifying investment potential or opportunities requiring immediate action), its core function is the systematic scoring of stocks.

What Cotter AI Does

Cotter AI's primary function is to assign a rating to each stock within the S&P 500, ranging from "Poor" to "Excellent." This rating is generated through a proprietary algorithm that uses the GPT model to process and analyze vast amounts of data. This data likely includes, but is not limited to:

- Financial statements: Analyzing key metrics like revenue, earnings, debt, and cash flow.

- Market data: Considering factors like stock price, trading volume, and market capitalization.

- News sentiment: Assessing the overall sentiment expressed in news articles and financial reports related to the company.

- Other relevant factors: Potentially incorporating qualitative data or alternative data sources to improve the accuracy and depth of its analysis.

The exact details of Cotter AI's analytical methodology are not publicly available, but the use of GPT suggests a sophisticated approach to natural language processing and data integration.

Main Features and Benefits

- Simplified Stock Evaluation: Cotter AI transforms complex financial data into easily understandable ratings, making it accessible to both novice and experienced investors.

- Time Savings: The tool significantly reduces the time spent on individual stock research, allowing investors to focus on other aspects of their portfolio management.

- Potential for Early Identification of Opportunities: The "RIP AI" categorization hints at its potential to flag stocks showing rapid improvement or decline, which could provide early warnings or identification of lucrative investment opportunities.

- Data-Driven Insights: The underlying GPT-powered analysis provides a data-driven approach to stock evaluation, minimizing subjective biases.

Use Cases and Applications

Cotter AI can be used by a broad range of investors and financial professionals:

- Individual Investors: Provides a quick and easy way to screen stocks and identify potential investment candidates.

- Portfolio Managers: Can be integrated into existing workflows to enhance stock selection and risk management processes.

- Financial Advisors: Offers a valuable tool for providing clients with data-driven investment recommendations.

- Quant Traders: Could be used as one data point within more complex algorithmic trading strategies.

Comparison to Similar Tools

Cotter AI differentiates itself from other stock rating tools through its reliance on a GPT model for analysis. While many tools offer stock ratings, few leverage the capabilities of large language models to integrate and interpret diverse data sources in the same way. Other tools may rely more heavily on traditional fundamental or technical analysis, or utilize simpler scoring methodologies. A direct comparison requires examining the specific algorithms and data sources of competing platforms, which is beyond the scope of this article.

Pricing Information

Cotter AI operates on a freemium model. This implies a basic level of access is available for free, while more advanced features or increased usage limits may require a paid subscription. The specific pricing details, including subscription tiers and associated costs, should be found on the Cotter AI website.

Disclaimer: This article provides information about Cotter AI and should not be considered financial advice. Investing in the stock market carries inherent risks, and it's crucial to conduct thorough due diligence before making any investment decisions.